For the better part of three years, markets have fretted about a 1970s-style inflation cycle. It seemed every inflation print mattered (sometimes to the nearest rounded second decimal point). Even more than other substantive issues, like how much profits companies were generating.

As the US inflation rate predictably normalises back to its pre-Covid levels, it seems the latest worry is now the possibility of a recession and fears the US Federal Reserve is now ‘behind the curve’ in terms of reducing interest rates1.

Focusing on the Sahm Rule

The US July employment report undershot expectations, posting a 110k job gain. This was soon followed by a rapid sell-off of the Nikkei Index (-15%), and a fall in the US market the following trading day. For a few days the markets were in turmoil and the fear of a looming US recession was to blame. Even the Federal Reserve has stated that the downside risk to employment has increased.2

Although a positive job gain for any month would seem a pretty benign recession indicator, commentators are now highlighting the trigger of the so-called “Sahm Rule”.

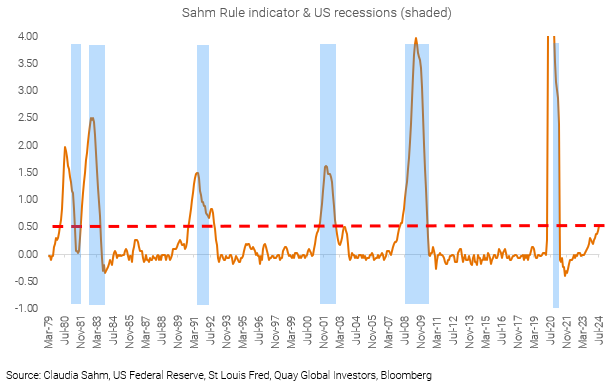

Named after prominent economist and former section chief at the board of governors of the Federal Reserve, the Sahm Rule states the start of a recession occurs when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

The track record of this indicator has been impressive.

However, we’ve seen these ‘perfect indicators’ before. In 2022 another perfect indicator, ‘inverted yield curve’, was to be the harbinger of the next recession, which failed to materialise.

In December 2022, we questioned the predictive power of the inverted yield curve, recognising that the once-in-a-lifetime pandemic, and the fiscal response to it, probably altered the economy in such a way that many of the old economic rules no longer apply.

So, could the Sahm Rule be another false alarm?

There are other recession indicators that point to ‘no recession’

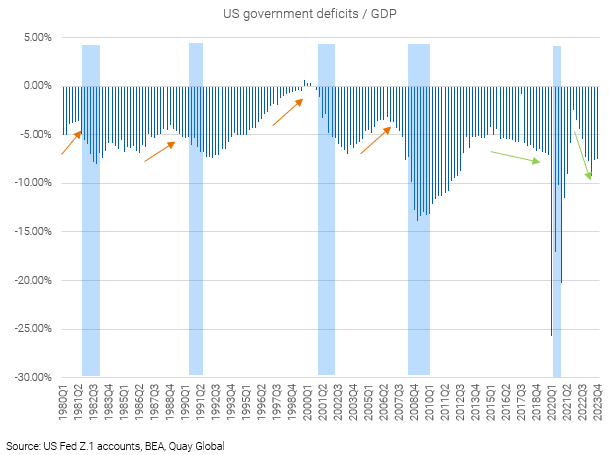

Another recession indicator is the size and direction of the US federal budget balance. Although not ‘perfect’, the historic pattern appears to be that whenever the US deficit is reducing, there appears to be risks that economy will either cool or enter a non-pandemic recession.

Alternatively, proactive deficit spending (that is, deficit spending not caused by an economic slow-down) is associated with sustained economic growth.

The reason is that unlike quantitative easing (QE), fiscal deficits actually reflect money printing.

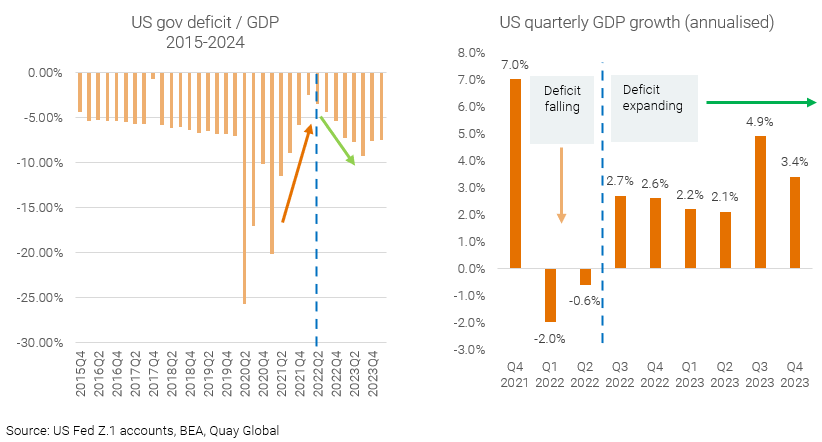

This significant fiscal expansion in 2022 wrong-footed many commentators that overly relied on the impact of monetary policy (and the inverted yield curve).

The large reduction in deficit spending in 2021 and 2022 led to a surprise contraction for the US economy in the same period.

The lesson seems to be if one is worried about the state of the US economy, the fiscal balances of the government should be part of the calculus.

Deficits are important for investors

Sadly, there is still a widespread belief a sovereign currency issuer like the US (and Australia) will face a fiscal crisis3 due to increasing levels of government debt. An idea that we debunked in our Modern Monetary Theory article.

And for those who have abandoned their fiscal crisis rhetoric, they have simply replaced it with the equally discredited ‘deficits cause inflation ’ mantra4.

But federal deficits are important (positive) for investors as the net spending adds to the financial assets of the non-government sector, supporting incomes and company profits.

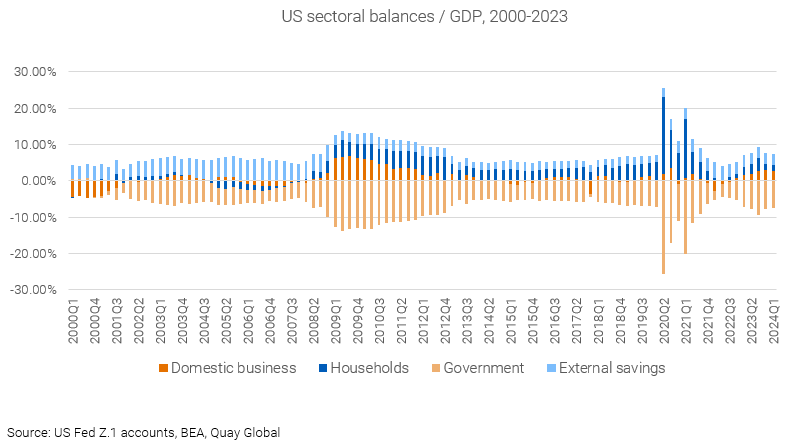

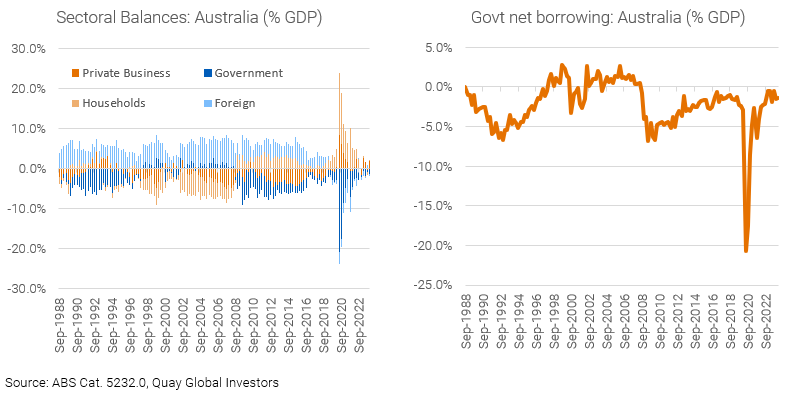

The impact of this ‘macro accounting’ is best visualised via the sectoral balances depicted in the chart below. In short, one person’s spending is another’s income. And one entity’s deficit is another’s surplus.

The recent data (Q1 2024) points to a fiscal deficit of -7.5% of GDP resulting in net savings to domestic companies (+2.7%), foreign savers (+3.0%) and households (+1.7%).

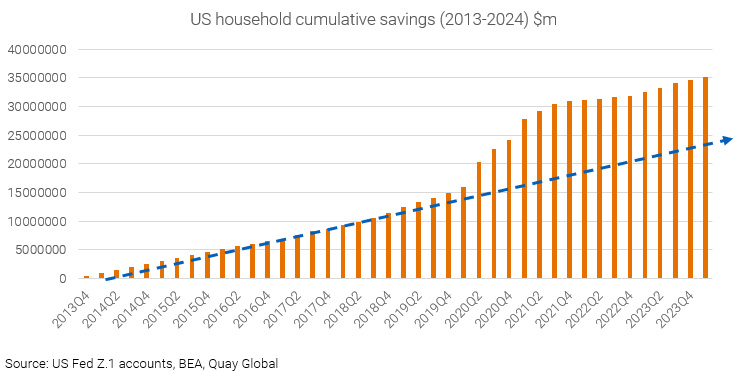

And while household savings are well down from the Covid peak (+21.1% of GDP) the accumulated savings since 2013 (+$35 trillion) have resulted in a household sector that is in ’rude health’. As per our previously published research, these accumulated savings are acting as a buffer against potential recessions, signalled by either the inverted yield curves or the Sahm Rule.

Meanwhile, company savings (as a % of GDP) has accelerated from 0.9% of GDP (Q4 2022) to +2.7% (Q1 2024). Is it any wonder why the US share market is booming? Thank the deficit.

More broadly, with a US deficit tracking at 7.5% of GDP – neither accelerating nor decelerating - it suggests an economy muddling through. And with US politicians focused on the November vote, it is unlikely this cadence will change any time soon. Based on this factor, it seems the odds of a US recession are pretty low.

What about Australia?

The economic reality of ‘one person’s spending is another’s income’ is universal and applied equally to Australia. But unlike the US, the consolidated fiscal deficit (federal and state) is contracting and, as of March 2024, stood at 1.4% of GDP.

Despite the start of the ‘stage three tax cuts’ in fiscal 2024, the forecast federal deficit is expected to remain around 1% of GPD over the next two years. And for those that suggest this is somehow inflationary, they would have to come up with some rationale why the US deficit (7x larger) is resulting in lower inflation.

The result of an absurdly small deficit in Australia is already resulting in weak economic performance, with real per capita GDP growth posting negative growth for the last five quarters.5 Given the lack of political will to run deficits necessary to meet the savings desires of the household sector, the structurally low fiscal deficits will inevitably lead to structurally lower interest rates as detailed in our article, Aussie interest rates are heading for zero (again).

Concluding thoughts

So, is the US headed for recession? Based on recent fiscal flows, the odds seem low. Using the same framework for Australia, the outlook is far less sanguine. As a caveat, we note that recessions are notoriously hard to predict.

At Quay, we are firm believers in the adage that it’s better to build an ark than try to forecast the weather.

In that vein, we maintain a portfolio tilted toward recession-proof of sectors such as senior housing, affordable accommodation and self-storage with companies supported by great management teams and solid balance sheets while benefiting from structural tailwinds.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] https://www.wsj.com/finance/investing/federal-reserve-behind-curve-1357e515

[2] https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

[3] https://siepr.stanford.edu/news/fiscal-instability-behind-ticking-time-bomb-us-debt

[4] Debunked as US deficits increased in 2022 and into 2024, coinciding with falling inflation

[5] https://www.brokernews.com.au/news/breaking-news/australias-per-capita-recession-continues-for-fifth-quarter-284864.aspx