This observation has been evidenced with direct investor responses. From the November Bank of America Global Fund Manager Survey:

- Global growth expectations jumped from -10% in October to +23%; the highest since June 2021.

- Global inflation expectations flipped from -44% to +10%; indicating investors fear rising inflation for the first time since August 2021.

In this month’s Investment Perspectives, we delve into whether these expectations will match reality. But first, let’s take a quick look back on how real estate performed under Trump 1.0.

Global listed real estate did OK last time

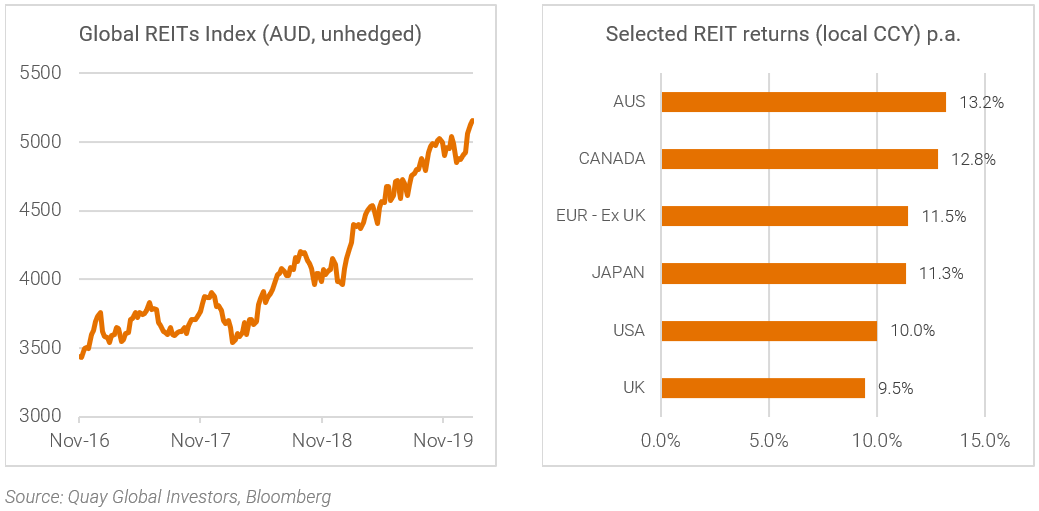

In the first three years of the Trump presidency (prior to COVID), global real estate performed well, delivering investors 13.3% per year compound total returns in AUD terms. In local currency terms, real estate did slightly better.

More broadly, real estate underperformed US equities due to the tailwind of large-scale company tax cuts in 2018 (REITs are generally not taxed). Based on campaign promises and rhetoric, it’s likely a second Trump presidency will deliver similar sized cuts to US companies – a benefit that will again miss the non-tax paying US REITs.

Regionally, most market did well, with Australia outperforming most developed markets. A “US first” centric policy, and tariff wielding administration did not seem to harm non-US markets, at least as far as real estate was concerned.

Unpacking some myths

We recently attended a number of advisor panels, and one of the key questions was “how will a second Trump term impact markets?”. What struck us was the near universal acceptance that Trump was ‘pro-growth’, and tariffs would be inflationary and slow the Federal Reserve rate reduction cycle. We believe both of these views are worth challenging.

Myth #1 – Trump policies are pro-growth

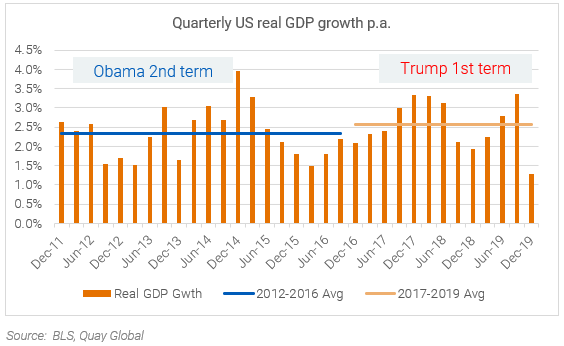

Ignoring the distortive effects of COVID and the early years of the GFC, real GDP growth during the second Obama term was roughly the same as Trump’s first, with both averaging ~2.5% per annum. Clearly, Trump’s so-called ‘pro-growth’ policies did not positively impact the broader economy.

What about jobs?

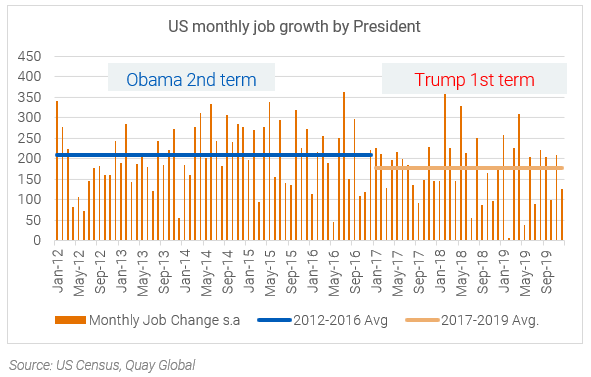

Again, after removing the effects of the GFC and COVID, job growth was roughly the same under Obama (211k per month) as Trump (177k per month).

Overall, Trump policies neither hurt nor boosted the economy. His overall handing of the economy could best be described as maintaining the momentum, and hardly what we would call pro-growth.

Myth #2 – Tariffs are inflationary

A necessary pre-condition for inflation is rising prices, however, it’s not the only pre-condition.

Inflation represents the ongoing increase in prices – a phenomenon that is caused by a fundamental mismatch between aggregate demand and economic capacity (supply).

To the extent the imposition of a tariff increases the price of a good or service, it does not follow such an increase represents inflation. At its core, a tariff is essentially a sales tax, and like most taxes, it acts as a drain on the financial resources of the non-government sector, reducing overall demand.

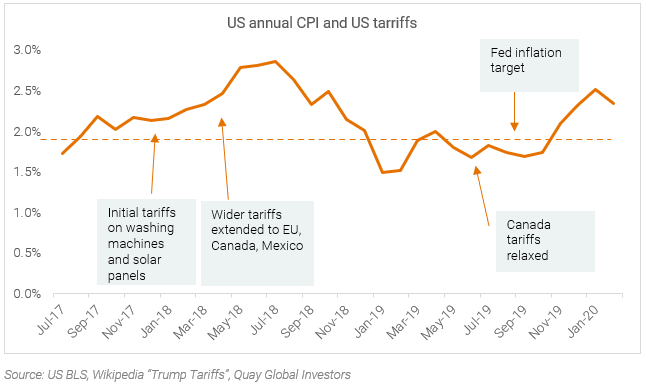

For evidence of this, look no further than the tariff regime under Trump’s first administration. Tariffs were progressively levied in 2018 (see chart below), and while the measure of CPI rose a little (reflecting the one off increase in selected prices), by 2019, the change in CPI was back below the Fed’s target as the anniversary of the initial prices rises cycled-out.

The Tariff policy was so deflationary, by August 2019 fears of a slowing economy prompted the Federal Reserve to restart an interest rate cutting cycle.

Government efficiency may be good, but it has macro implications

One of the bigger unknowns in Trump’s second term is the extent of (if any) spending cuts in order to “fund” company and other tax cuts and improve government efficiency.

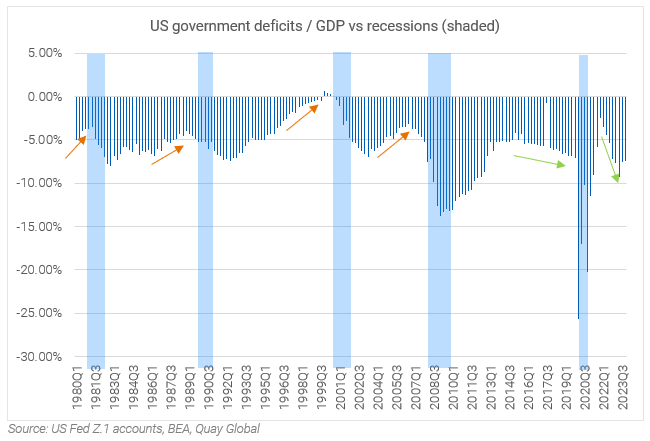

Increasing government efficiency is a good thing. Being able to do more with less improves the productive capacity (speed limit) of an economy – and excess federal workers will add to private sector labour pool. However, the transition impact of such a policy should not be overlooked. A large and rapid increase in private sector labour availability will dampen wages, while the cuts to government spending (and reduced deficit) will almost certainly slow the economy – as it has done in decades past.

And for readers who understand the relationship between government deficits and company profits, such large cuts will act as a significant headwind to company earnings.

Trump will benefit from some early deflationary tailwinds

While market expectations are shifting to a higher growth, higher inflationary environment, there remains decent disinflationary tailwinds already baked in for the early months of Trump’s second term.

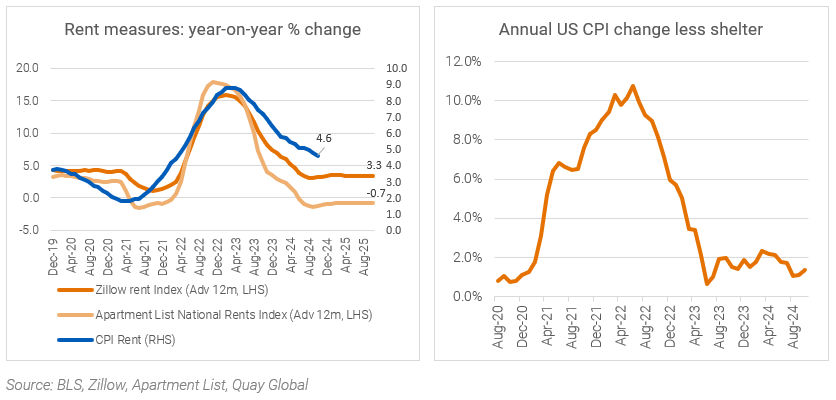

As the following chart highlights, the lagged impact of shelter in the CPI has yet to catch up to private sector residential rents. And when it does, the outsized weighting of this component on headline (30%) and core CPI (40%) will reduce inflation below the Fed’s 2% target, which may provide the market comfort the Fed can continue to reduce interest rates well into 2025.

Concluding thoughts

Based on post-election bond yield movements and investor surveys, there appears to be a widely held view the second Trump term will be positive for growth, with the risk of over-stimulating an already strong economy. Moreover, the spectre of a more aggressive use of tariffs add to the inflationary concerns.

However, historic data suggests a different risk. At best, Trump is neither pro-growth nor a risk to the current economic trajectory. However, the impost of tariffs (a consumer tax) while aggressively reducing government spending may reverse the fiscal deficit which (based on history) will slow the economy and tilt the risk toward a more deflationary cycle than market participants currently expect.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.