As we’ve discussed in previous Investment Perspectives articles, we believe when it comes to economic growth, central bankers and markets generally overestimate the impact of monetary policy, as evidenced by the anaemic recovery from the 2008-2009 crisis, despite a zero interest rate policy (ZIRP) and quantitative easing.

But now it’s a different battle.

Today’s battle is not about lack of growth, but too much inflation. Are central banks effective in this fight?

Using interest rates to fight inflation was an accident of history

Since the great depression, fiscal policy was the dominant policy tool for managing the economy – both employment and inflation. Then, during the 1970s, the oil price shock and corresponding spike in inflation (supply side) led to a new way of thinking. US economist and Nobel laureate, Milton Friedman, and others, championed the idea that inflation was simply a money supply problem. And since central banks controlled the supply of money, they should be responsible for controlling inflation.

So, central banks were then charged with the goal of managing the supply of money.

How did we move from managing the money supply to moving interest rates? The transition is well-summarised by economics professor, Bill Mitchell:

“Friedman had told everyone that the 1970s inflation was because the money supply was increasing too quickly, and, as the central bank controlled the supply, they should set strict growth rules which would control the inflation rate.

First, central banks cannot control the money supply growth, which is the result of a multitude of decisions by businesses and household seeking credit from the banking sector.

The mainstream textbooks still teach that fiction and students in banking courses leave totally ignorant of the real world.

Second, the underlying theory – Quantity Theory of Money – that justified the monetary rule was inapplicable to the real world and Keynes had destroyed it in the 1930s.

But, in total denial of the evidence, the central banking community became rabid Monetarists and other central banks tried to impose monetary targeting in the late 1970s and into the 1980s and all failed badly.

It became obvious that the central bank cannot control the growth in the broad monetary aggregates (the money supply).

At that point, they shifted strategy to inflation targeting through the adjustment in interest rates”.1

Inflation management track record

The underlying idea of central banks controlled the money supply, and hence inflation was abandoned in the 1980s and replaced by interest rate policy, for no reason other than the first idea didn’t work.

So, do interest rates work?

Part of the answer can be found in the central banker’s own rhetoric.

In the aftermath of the financial crisis, the monetary policy mantra seemed to be ‘lower for longer’.

In a post-pandemic world, the ‘lower for longer’ mantra has been replaced with ‘higher for longer’.

One would think if monetary policy worked, there would be no need to keep waiting ‘longer’ (in some cases decades) to get the desired policy outcome. Despite a ZIRP policy and unending QE, Japan has waited 25 years for inflation to re-emerge. Talk about long and variable lags!

Even our own RBA falls into this category. After the recent (June) monetary policy decision, the Board indicated the economic outlook was "highly uncertain”2. This again highlights the lack of confidence in the central banks’ own framework and policy prescription for the current environment. This is of little comfort for the future 200-300,000 people targeted to lose their jobs in the name of this policy prescription3.

Central banks are right to lack confidence in their own machine

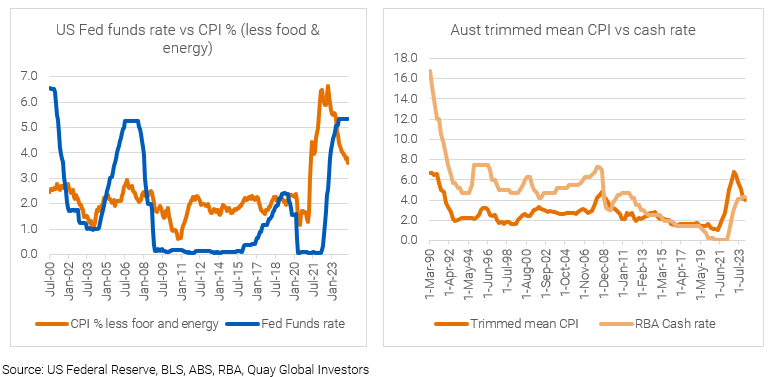

Central banks are correct in being uncertain about their policy implications. Since the early 1990s, there appears to be very little relationship between movement in interest rates and inflation. For example, consider the US where:

- ZIRP (supposedly inflationary) from 2009-2015 didn’t alter inflation much at all,

- then interest rates increased (2015-2018), yet inflation barely changed,

- then interest rates fell (2018-2019) and inflation stayed the same, again.

The only occasions where inflation appears to fall was due to the external shocks of the tech-wreck (2001-2003), the GFC (2008-2011), and the pandemic (2020).

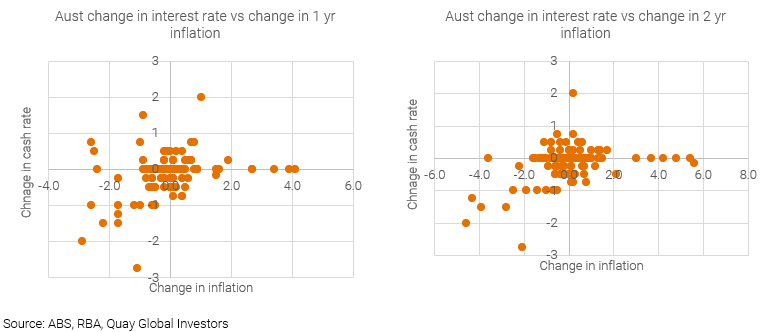

In Australia, the data is no less damning. The following scatter plots shows that, if anything, there appears to be a positive correlation between interest rates and inflation (that is, higher interest rates cause higher inflation).

Outside Australia and the US, we have additional examples of the lack of impact of monetary policy.

As mentioned earlier, Japan is a classic case in point. However, we note some like to make excuses for Japan, such as its demographics, geography etc. But we can see inconsistencies between monetary policy and inflation just about everywhere we look.

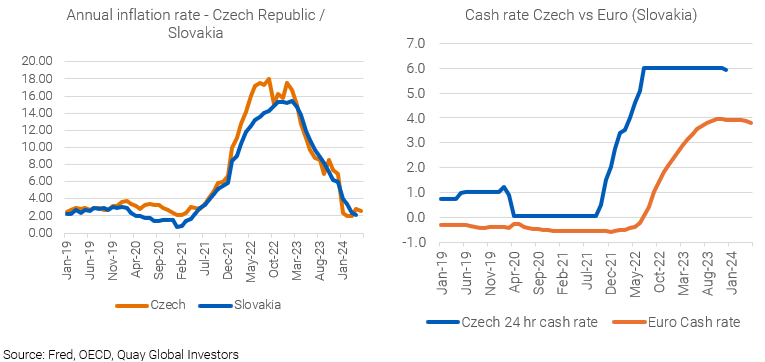

Moving to another part of the world, we find more examples. The charts below highlight the data between Czech Republic and the Euro member Slovakia. Both countries share similar demographics and geographies. And as such, both have similar growth (c 1% GDP growth in 2023) and supply chain issues coming out of the pandemic. Despite the delay in interest rate hikes in the Euro, and a lower end cash rate, the inflation outcomes for both countries are identical. Surely if interest rates worked ‘as advertised’, these like-for like examples would show different inflation outcomes.

Why interest rates do not work for inflation

Whether it’s the US, Australia, Japan, Slovakia or the Czech Republic, the data simply does not support the idea that interest rates deliver the desired inflationary outcome. Generally, there are three reasons for this.

Private sector income flows are neutral

Monetary policy advocates argue changes in interest rates impact borrowers. Higher rates are negative. Lower rates are positive. So, higher rates curb spending and slow the economy with a corresponding decline in inflation. However, as we have written previously in our Modern Monetary Theory Part 2 article, and as highlighted by Bank of England, loans create deposits. For every private creditor there is a private debtor. Therefore, any pain or benefit felt by a borrower from a change in interest rates is offset (exactly) by the pain or benefit for savers or deposit holders.

In the private sector, interest rate policy creates no net negative or positive income flows. It’s a wash, albeit with some significant distribution effects; specifically, people with money earn more money. It’s little wonder then why, in the current rising interest rate climate, luxury retailers are trading so well4 while low-income retailers struggle5.

From a private sector income flow perspective, monetary policy is like driving a car with one foot on the accelerator while the other is on the brake.

Higher interest rates ADD to the money supply

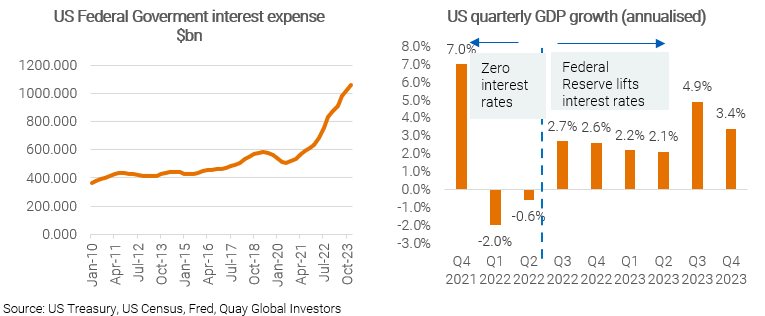

An emerging excuse as to why interest rate policy is not working as intended is that the government is ‘spending too much’, which is working against the central bank actions. Of course, the main reason governments are spending is because of interest rate policy.

Take the US for example. Like most countries, the US government has a net debt position. This means any interest paid is a net (positive flow) to the private sector. As interest rates increase, this flow accelerates, effectively becoming stimulus.

In this context, is there any surprise the US economy recovered strongly AFTER the Fed began to increase interest rates? And since GDP growth began to accelerate, inflation has declined.

Higher interest rates increase the cost of production & prices

One of the long-held economic beliefs (since the 1970s) is higher wages leads to inflation. Quite often referred to as a ‘wage-price spiral’.

The idea is simple enough. Higher input costs for businesses are readily passed onto consumers – who in turn demand higher wages, and so forth.

What is less discussed is businesses also have a ‘cost of capital’. And for capital-intensive industries, this cost is meaningful. So, the same logic should apply – higher input cost of capital raises prices, raises inflation and raises the cost of capital.

We see this today in real estate, especially housing. Current interest policy has resulted in a higher cost of funding, and hence, making new projects less viable. Less supply results in higher prices (rents) feeding into higher inflation.

While it’s debatable whether there is currently a wage-price spiral, it seems clear there is a capital cost price spiral driving residential rents.

Concluding thoughts

At the beginning of the year, the US Federal Reserve indicated there would be three interest rate cuts in 2024. At the time of writing this paper, the new Fed ‘dot plot’ now suggests just one.

At the same time, our own RBA remains confused on how the economy will perform despite its conviction high interest rates work ‘as advertised’.

The bottom line is the use of interest rates policy as a tool for controlling inflation was an accident of history. It should therefore come as no surprise its track record is dubious, at best.

At Quay we never position for interest rate policy. It seems jumping from one policy statement to the next is not helpful, especially when those making the statements are equally lost and confused as the impact of their own policy choice.

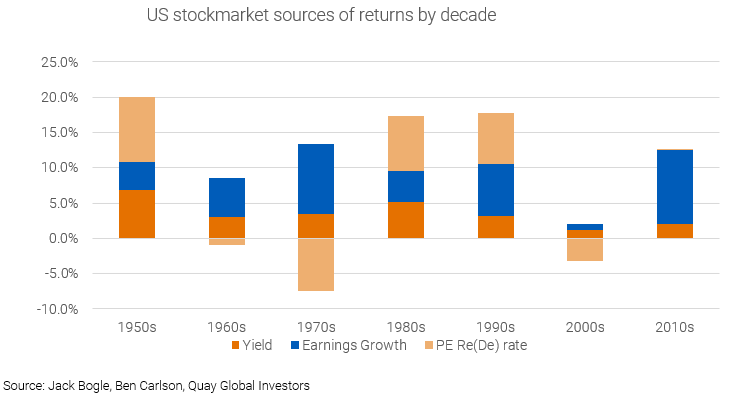

Instead, we fundamentally believe that buying high-quality companies with structural tailwinds and deep discounts to replacement cost is the best way to preserve capital and generate sustainable long-term returns. For long-term investors, interest rates matter far less than total returns driven by earnings growth and dividend yield. And if history is any guide (see below), we’ll be proven right.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[2] https://www.rba.gov.au/media-releases/2024/mr-24-12.html

[3] The rba wants more unemployment

[4] The one retail sector where soaring prices wont stop people buying

[5] Inflation squeezes low income spending