Indeed, the European Central Bank, Bank of Canada, Swiss National Bank and others have already cut rates at least once this cycle.

With inflation now (apparently) in the rearview mirror, some investors may begin to think about allocating more to so-called interest-rate-sensitive sectors. Although we argue the long-term correlation between interest rates and listed real estate is statistically zero (more on that below), we can understand why many feel the timing to allocate more to the sector is drawing near.

Timing allocations is hard

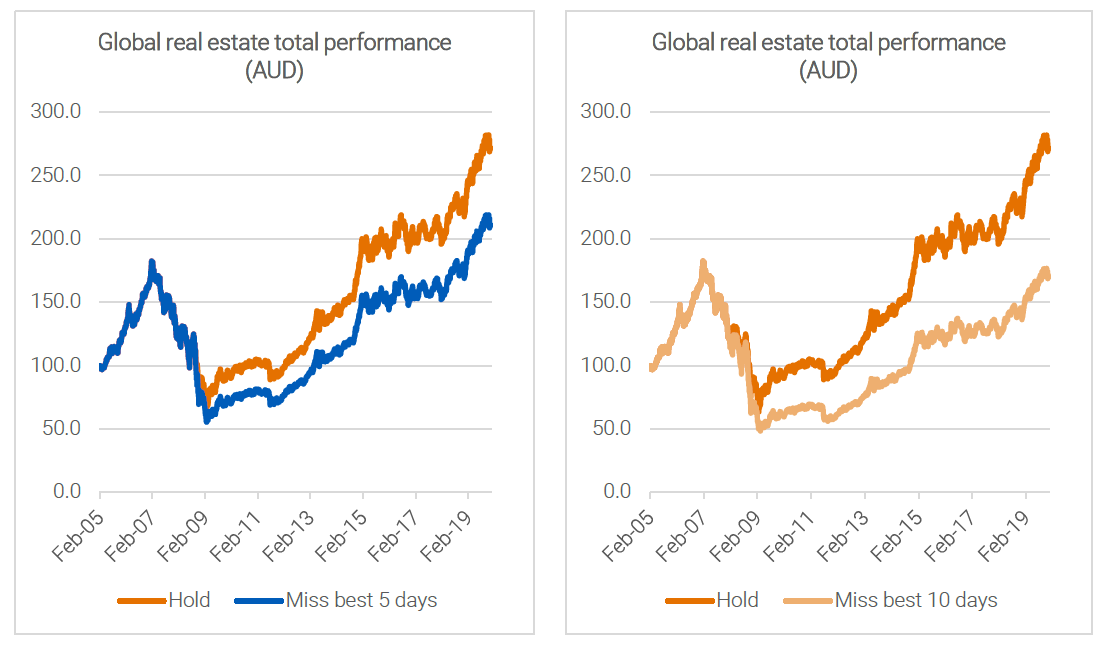

Between 2005 and 2020 (prior to the pandemic), global real estate delivered Australian investors a 171.4% total return. Out of the 3,870 trading days over that period, if investors missed just the top five ‘up days’ that return falls to 110.7%. Missing the top 10 up days, the return falls to 70.1%.

Source: Quay Global Investors, Bloomberg

For seasoned investors, this data should come as no surprise. Analysis across different sectors yields a similar outcome. For global equities (in AUD), the total return fall from 205% to 187%, and then to 142%. However, the takeaway here is the miss on global real estate can be more significant.

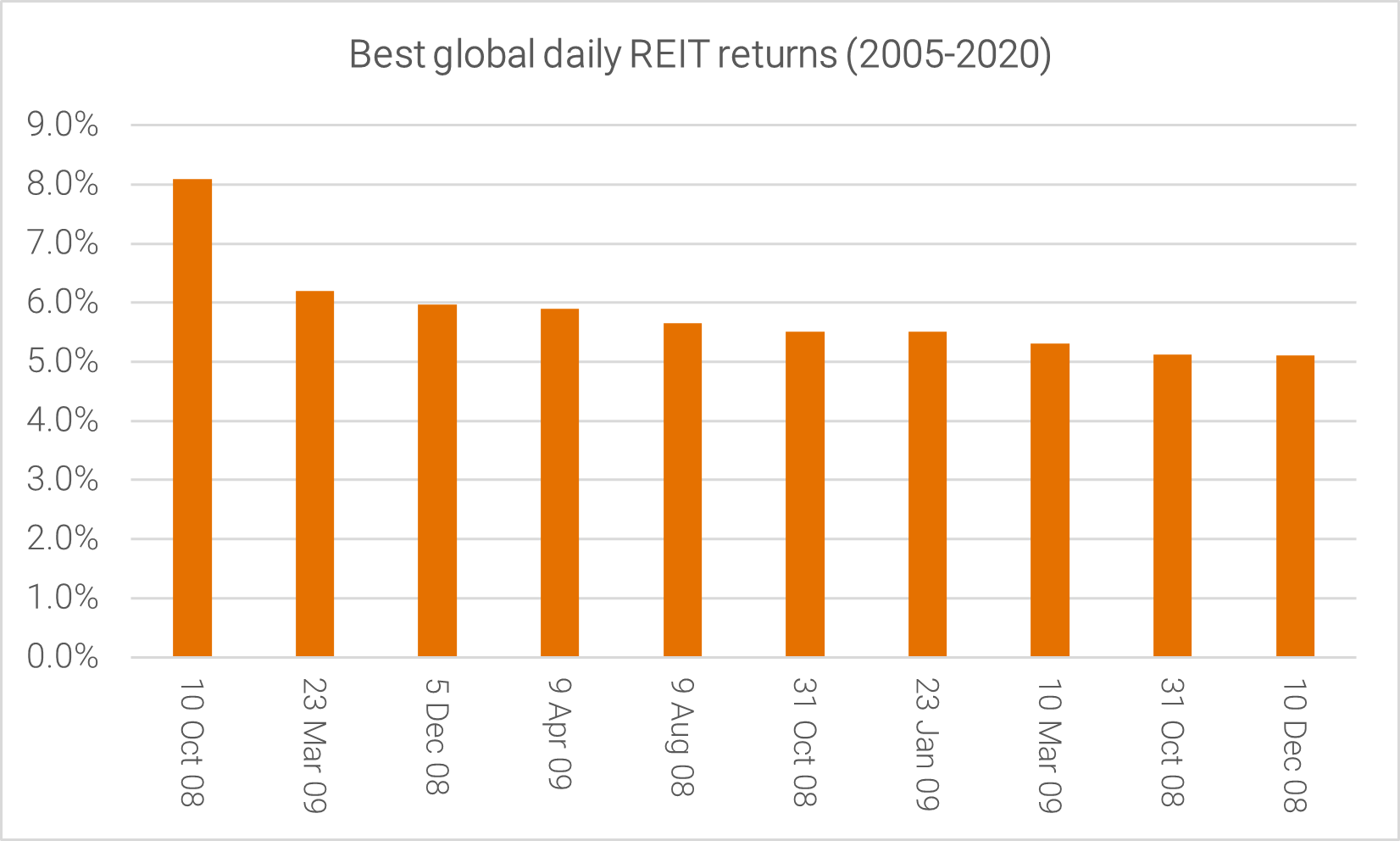

Again, it’s probably no surprise that the best up days during this time was when the sector was ‘most out of favour’. Predominately during and emerging from the financial crisis.

Source: Quay Global Investors, Bloomberg

History can be a guide

After a very strong monthly performance in July, some investors may feel as though they have already missed the boat. However, history suggests there is time to capture future performance.

Despite an interest rate easing cycle having already commenced in some developed markets, all eyes, as always, are on the US and the Federal Reserve. And the fact the Fed has not yet reduced interest rates just yet (at the time of writing), suggests there is some future performance yet to be captured.

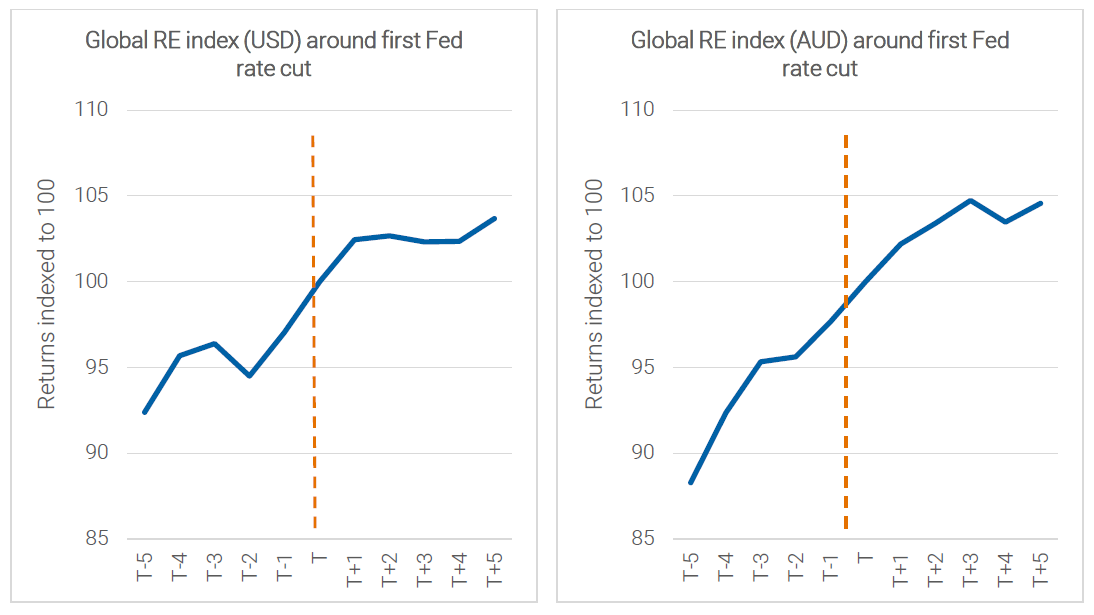

The charts below show the performance of the global real estate market (in AUD and USD terms) in the five months prior to and after the first cut in interest rates by the US central bank.

Source: Quay Global Investors, Bloomberg, FTSE EPRA NAREIT Index

Based on first Federal Reserve (US) interest rate cuts average of June 1995, Dec 2000, July 2019 (excludes GFC / COVID)

In both cases, the global real estate market begins to perform well in advance of the first cut. However, even for those that miss this moment, the sector continues to perform in the months following. And while it may seem counterintuitive, the better returns for Australian investors come from an unhedged exposure (chart on the right). That is, the AUD does not typically outperform the USD when the Fed begins to cut.

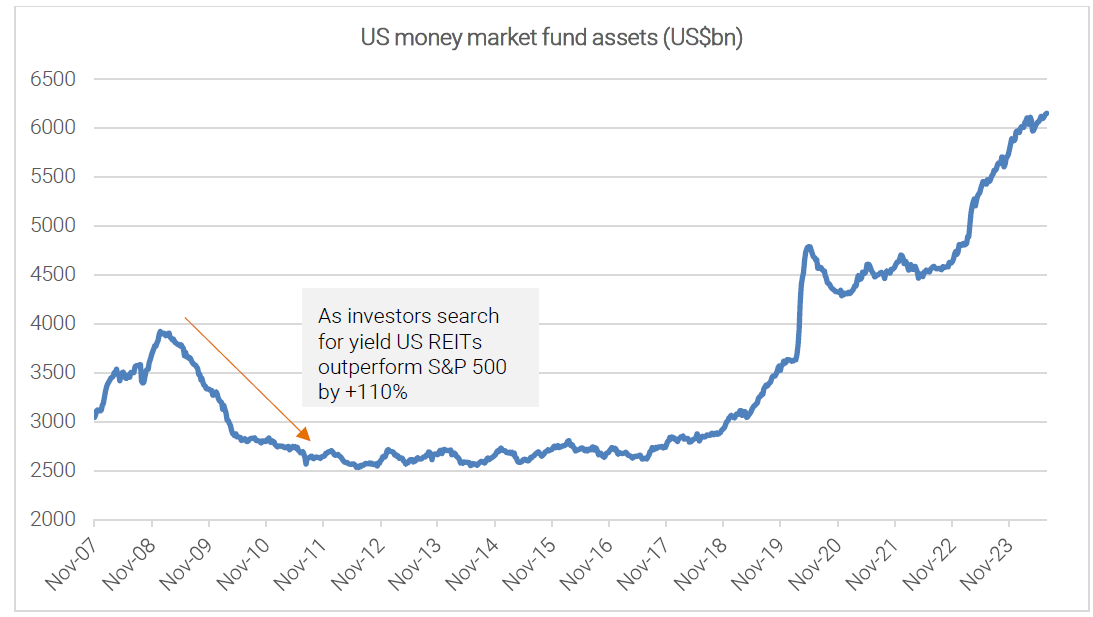

Part of the reason REITs rally around the first interest rate cut is investors begin seeking better yields in a potentially lower interest rate environment. If that is the case this time, it’s worth highlighting the amount of cash sitting in US money markets dwarfs prior cycles. This could drive the cycle well beyond the initial sugar hit.

Source: Bloomberg, Quay Global

What if inflation (and rising interest rates) return?

After the relative underperformance of global real estate since 2022, this is a fair question. Yet, while it may feel that listed real estate is highly correlated to changes in interest rates, the data tells a more nuanced story.

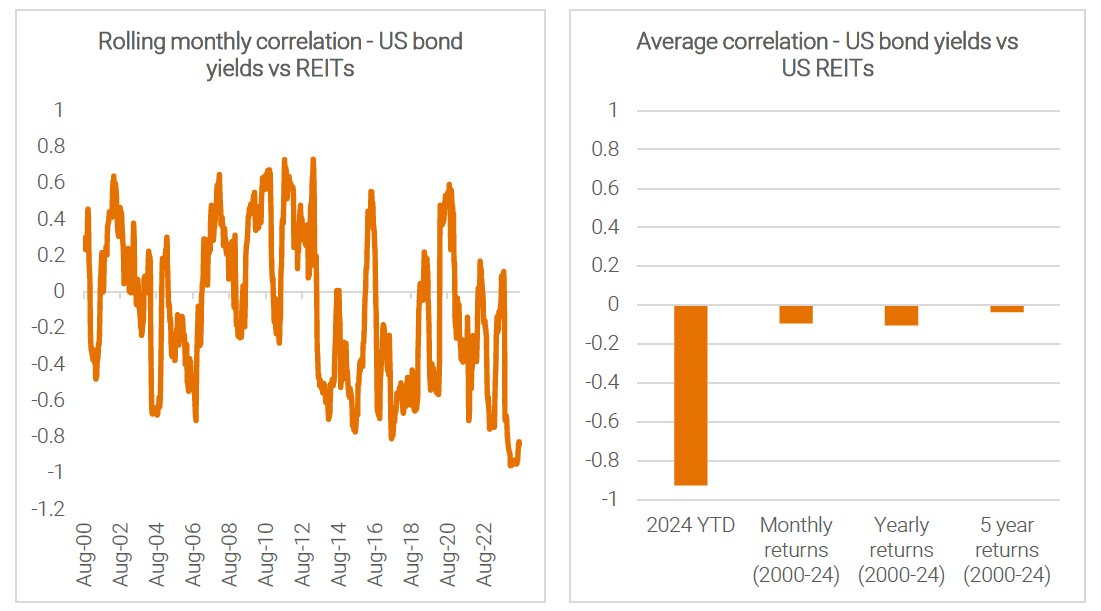

The following charts highlight the rolling correlation between US interest rates (10-year bond yields) and US REITs since Jan 2000. The chart on the left chart shows the rolling correlation of monthly returns and highlights the correlation is not always one-way. In fact, over time, one would be forgiven for believing there is no long-term correlation at all.

Such intuition is supported by the chart on the right that highlights the longer the hold period, the lower the correlation between bond yields and listed real estate. On a rolling five-year basis, there is no statistical correlation at all.

Source: Quay Global Investors, Bloomberg

In short, the longer the hold period, the less relevant any view on interest rates become.

That’s because the long-term driver of real estate is replacement cost. The higher the cost to build, the higher the hurdle for new supply to become feasible. And a lack of supply means pricing power (and earnings growth) for landlords.

We’ve seen this movie before – admittedly a long time ago.

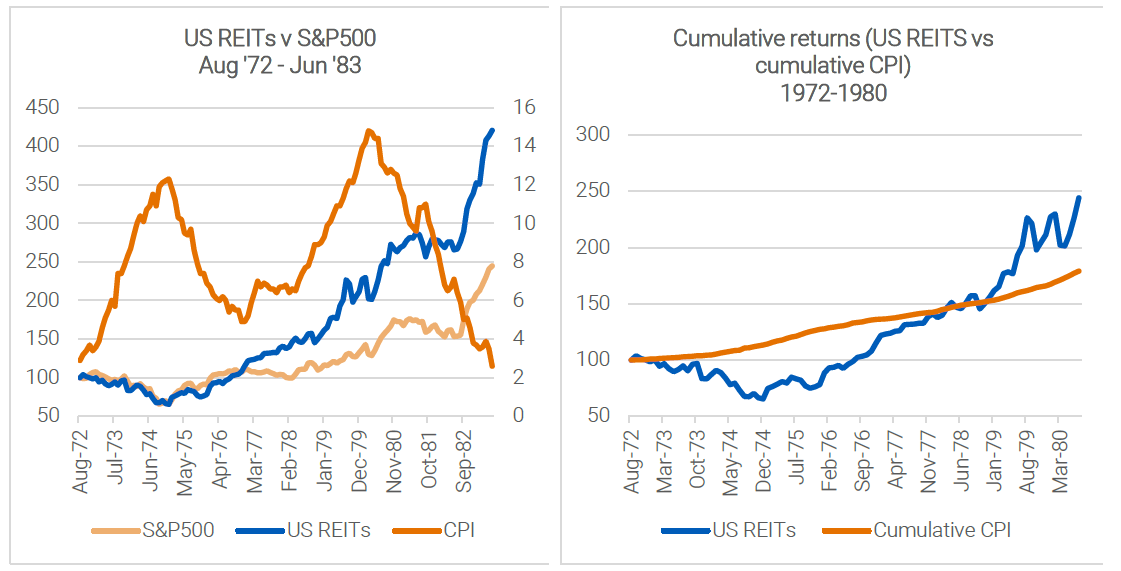

In the 1970’s, inflation in the US surged, followed by rising interest rates. Famously, despite some inflation relief by the mid-1970s, it surged again into the early 1980s.

And what happened to listed REITS?

Like today, they initially fell. However, lack of new supply and rental pricing power resulted in very strong performance in the back-half of the decade – at the same time inflation was re-emerging.

As the chart on the right demonstrates, holders of real estate may feel frustrated with performance in the early innings of an inflation cycle. However, in a country where the population is growing, prices simply cannot stay below replacement cost forever, and the following price recovery can be meaningful.

Source: Robert Schiller, NAREIT, FRED, Quay Global Investors

Concluding thoughts

Timing the markets is hard. Miss a few good days and long-term total returns can alter significantly. This is especially so for listed real estate.

The good news is there are signs that suggest a few of these good days are still ahead of us. History suggests listed REITs run in anticipation of US Fed rate cuts and continue to perform for some time after.

Moreover, higher building costs is already resulting in a shortage of global real estate, as the development equation does not work. A resurgence in inflation and building costs will simply squeeze future tenants all the more – to the benefit of landlords.

At Quay, we see a world awash with opportunities and value. We remain fully invested.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.