Rents have surged in the years post-Covid as the population boomed. As we’ve written in previous Investment Perspectives, the demand/supply of housing, and changes in replacement cost, are the long-term key drivers for residential property, not interest rates.

Unfortunately, there are no pure listed residential rental REITs in Australia to take advantage of the significant local demand and supply mismatch. However, there are opportunities in countries that are seeing similar dynamics play out.

We believe one such country is in Canada.

Canada’s population is booming – and there are not enough dwellings

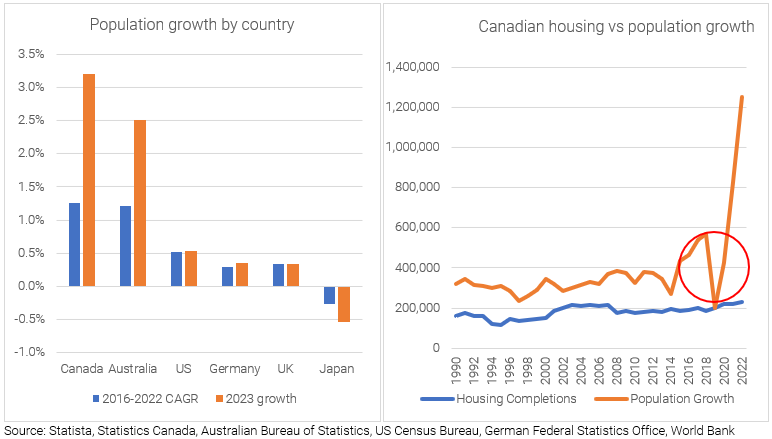

In 2023, Canada’s population grew by a staggering 1.25 million people, with only approximately 28,000 via natural gains (births minus deaths). This reflected a population growth rate of 3.2%, Canada’s highest percentage increase since 1957. Importantly, like Australia, Canada has historically had a progressive immigration policy, with +1% per annum population growth prior to the pandemic.

Despite the surge in population, annual housing completions since 2016 remain in line with historical averages at around 200,000 to 230,000 per annum. This means the gap between population (demand) and housing (supply) has widened significantly, driving down national vacancy rates and pushing rents higher.

New permanent migrants to Canada typically rent, at least for the initial few years. Temporary migrants, such as foreign students, almost always rent, particularly after the Canadian government banned foreign purchases of housing for two years from 1 January 2023. They recently extended this measure until 1 January 2027.

The result? Demand for rental housing has skyrocketed.

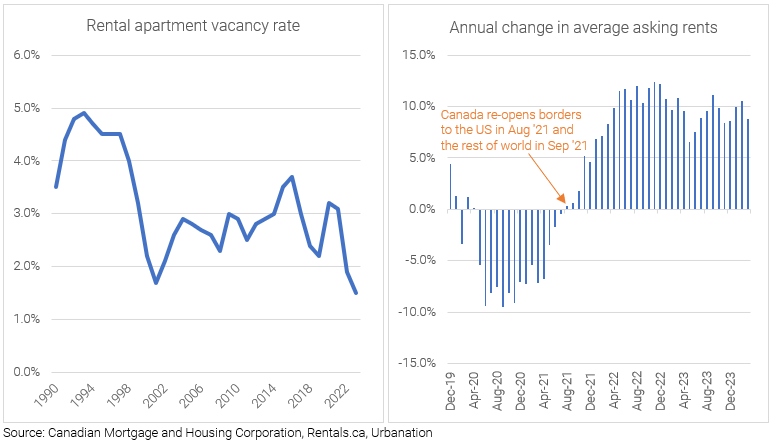

Data from Canada’s federal housing agency, the Canadian Mortgage and Housing Corporation (CMHC), shows that apartment rental vacancy rates have more than halved in the space of two years – from 3.1% in 2021 to 1.5% at the end of 2023. In large cities like Vancouver and Toronto the vacancy rate is even lower – at 0.9% and 1.4% respectively.

For Australians, this sounds all too familiar.

This squeeze on vacancy has led to a surge in rents. The chart on the right (above) shows average asking rents on rental listings. After Canada re-opened its borders in August/September 2021, market rent growth surged.

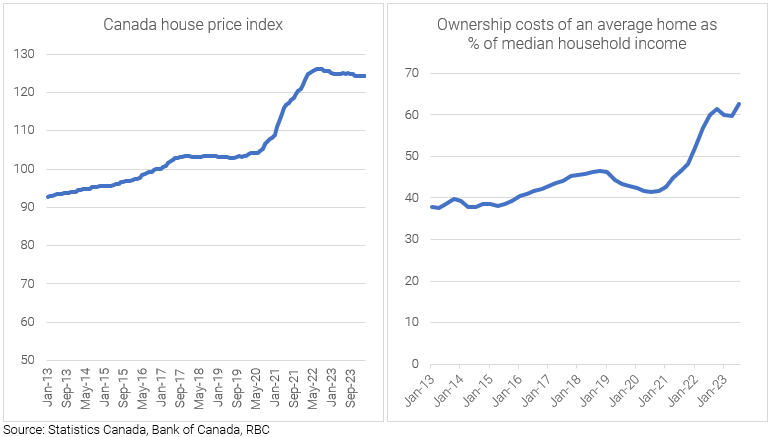

And as we learned in Australia, if rents are growing, values are supported (despite mortgage rate headwinds), as the following charts highlight.

Much like the scenario playing out in Australia, the chart on the left (above) shows how house prices in Canada have moved higher over the past decade, particularly post-Covid, as demand exceeded supply.

While prices have come down slightly in Canada due to higher mortgage rates, they appear to have now found a floor. Moreover, the modest fall has not been enough to make home ownership affordable. Perversely, with the rise in interest costs, it’s now harder for a household to acquire a dwelling than it was pre-rate hike cycle.

The chart on the right (above) shows home ownership costs as percentage of median income has risen to over 60% vs high 30% a decade ago.

Unsurprisingly, this has driven more demand for rental housing. However, the similarities in Australia don’t end there. Reflecting a similar outcome to RBA policy in Australia, higher interest rates in Canada are creating headwinds for new supply.

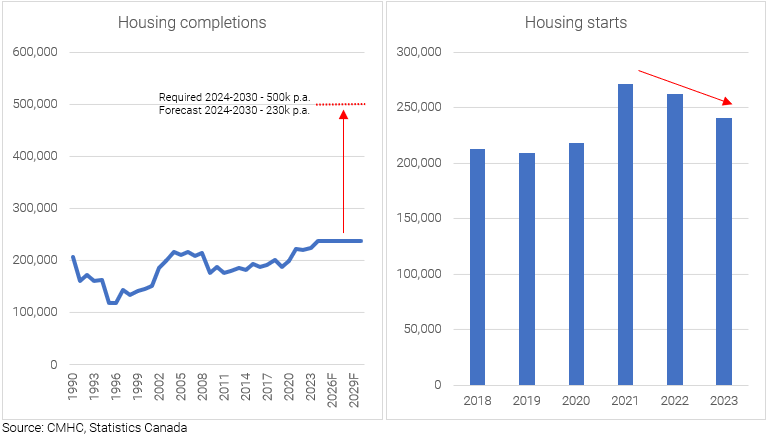

According to recent analysis by the CMHC, Canada needs 3.5 million new homes by 2030, which annualises to 500,000 per annum basis. However, completions historically have been running in the ~200,000 level per annum, and CMHC’s forecast is for 230,000 homes per annum to be built between 2024-2030.

This a significant gap, even if we allow for some overestimation error in the number of new homes required.

Importantly, the analysis by CMHC is based on a forecast population of 42.8 million in 2030. However, the actual population per Statistics Canada in the first quarter of 2024 is 40.8 million. This implies just +2 million people from now until 2030, after the population just increased by 1.25m in one year.

The government recently announced a reduction in immigration intake yet that will still add net 1.5million people between 2024-2027. In other words, chances are the analysis by CMHC is based on population data that will be too low.

To compound matters, housing starts (i.e., future completions) have actually been falling since 2021, as rising interest rates have made developments harder to economically justify. The government is encouraging new supply by recently announcing a waiver of certain taxes on developments, and providing cheaper development funding, but general consensus among industry participants is that it’s nowhere near enough.

There is opportunity to invest in this story in the listed REIT space

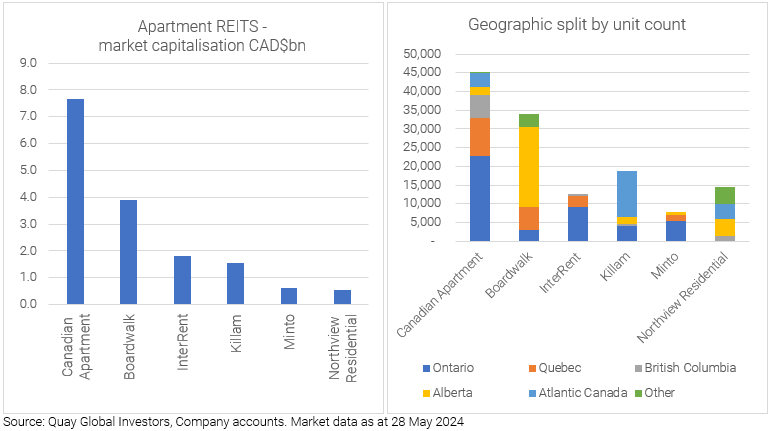

Unlike in Australia, there are a number of listed REITs in Canada focused on apartments for rent (rather than via residential development). These range from the largest, Canadian Apartment Properties REIT, with a market capitalisation of just under CAD$8 billion, down to Northwest Residential, the smallest at CAD$0.5bn. Together they represent less than 3% of the total rental market in Canada.

These REITs vary somewhat by geographic positioning within Canada. Boardwalk is the Alberta specialist and Killam is weighted towards Atlantic Canada. Together they are invested in the fastest growing provinces of Canada. InterRent is weighted to Ontario and Quebec, the two most populous provinces, and Canadian Apartment Properties REIT has exposure throughout Canada.

Housing investment in Canada plays by some unique rules

One key feature of Canadian rental housing is that many provinces have some form of rent control.

The maximum rent increase in a year i.e., the ‘cap’, currently ranges from 2.5% in Ontario to 5.0% in Nova Scotia. In provinces such as Alberta, there are no caps. However, there are some key nuances – even in the toughest rent-controlled provinces, there are no rent caps on tenant turnover (new tenants), no caps on rents in new buildings (built after 2018), and landlords have the ability to charge above rent cap increases if they carried out renovations.

Another key feature, and perhaps the most important one, is years of rent-control has meant in-place rents in these REITs portfolios are significantly below market. This gives the ability for these companies to grow rents (revenues) even when market rents are flat.

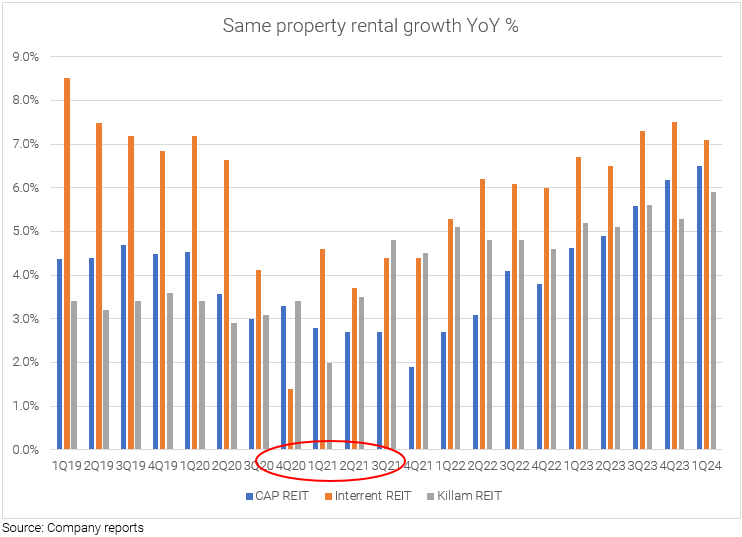

In the chart below, we can see the REITs continue to grow the same apartment average rent, even in the 2020/21 period during peak-Covid and closed borders (where market rents slid 5-10%).

Current mark to market spreads on portfolio rents reported by the REITs, such as Killam and InterRent, are in the vicinity of 30%. This future ‘rent catch-up’ on turnover effectively provides a solid runway of earnings growth into the foreseeable future.

In other words, annual rent growth of +6-7% per annum is now likely to be the norm for the foreseeable future (six to seven years)

Lower interest rates will drive housing turnover = faster rent growth

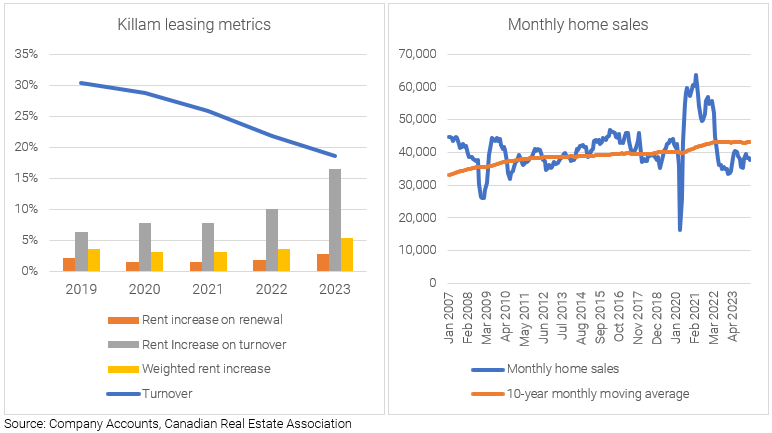

As the rental market became tighter over time, two things happened – first, the REIT’s portfolio turnover percentage dropped as tenants became more wary of moving out of their below-market rent apartment. The second is rent increase on turnover became a significant driver of earnings. The chart on the left (above) illustrates this dynamic playing out in Killam’s portfolio, and this trend is fairly consistent in many of the Canadian REIT portfolios. Apartment REITs with the ability to capture the gain-on-lease faster are likely to experience outsized earnings and share price growth.

Furthermore, as interest rates rose, housing affordability declined, negatively impacting rental portfolio turnover. The chart on the right (above) shows that monthly home sales in Canada remain below the 10- year monthly moving average. Turnover may increase if or when the Bank of Canada starts to cut rates. Rate cuts also mean lower interest expense i.e., more of the rental growth falls to the earnings line for the apartment REITs, driving further upside.

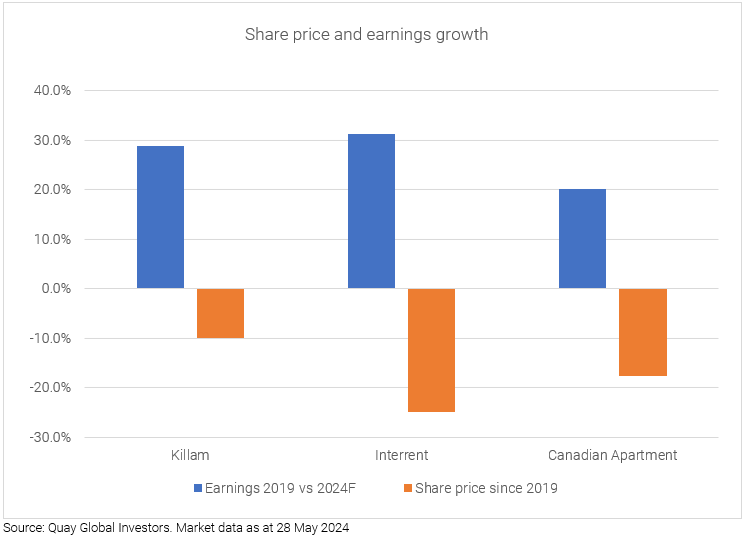

Despite earnings growth, share prices have not increased

In our view, there are a few reasons for this.

The first is purely macro. Most investors are not focused on the underlying fundamentals and instead are making short-term decisions based on macroeconomic events and themes. To us, this represents an opportunity.

Secondly, and more specific to Canadian residential REITs, is they are relatively more levered than their global peers as they can uniquely take advantage of loans guaranteed by the government (CMHC). This is another unique aspect of Canadian housing.

Loans insured by CMHC allow landlords to obtain mortgages at the five or 10-year government bond rate plus a spread of only 100 basis points. Financing is effectively guaranteed by the Canadian government, the only uncertainty is the bond rate (this market remained open for the REITs, even during the worst times of the GFC). In other words, these REITs have a funding advantage relative to their residential peers in the US and the UK. As a result, their leverage has trended relatively higher, with net debt/EBITDA ratio in the low teens.

Leverage can work to an investors advantage if valuations are cheap.

Valuations look compelling

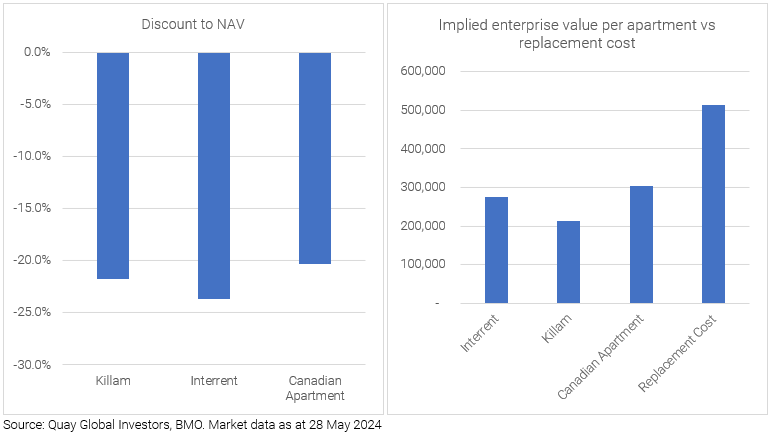

Canadian residential REITs are currently trading at a greater than 20% discount to their net asset values. This is an opportunity, in our opinion, as these REITs have been selling non-core apartments recently at, or in many cases, above book value. On this basis, it seems very unlikely that there is a big write-down yet to come. An investment into these companies at current valuations allow an investor to buy these apartments for ‘cents in the dollar’ of their private market valuations.

Furthermore, the chart on the right (above) shows that these REITs are trading at deep discounts to replacement cost. In the seven projects underway or completed by Killam and InterRent since 2022 in Ontario and Nova Scotia, development cost per apartment has averaged ~$500,000. However, current implied enterprise valuations per apartment are only 40-60% of this number. Of course, there are nuances – for example differences in location and age, however this is a large enough gap to provide investors comfort.

Concluding thoughts

It seems every second day there are local headlines discussing the social, economic and political implications of the housing shortage in Australia. For local investors, the only way to play the housing shortage thematic is via direct investment, which carries with it high transaction costs (stamp duty etc), direct maintenance and leasing costs, along with the time required to find such an opportunity.

An alternative is via global real estate where there is a wide array of listed passive housing REITs across multiple geographies where access is cheaper (lower transaction costs) and are already professionally managed.

One area that is a standout to us is Canada. With similar population growth and supply constraints as Australia, Canadian housing REITs are currently selling for ‘cents-in-the-dollar’ in the public markets. We believe they provide an excellent long-term opportunity for the patient investor.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.