The lure of gaining exposure to the mega-themed Artificial Intelligence (AI) boom via the stability of real estate has attracted operators and investors alike.

Is this theme real or hype?

Through the following series of charts, we seek to update our readers on the latest happenings in the data centre asset class (particularly from a global perspective) and illustrate how the theme of AI can be invested in through listed real estate.

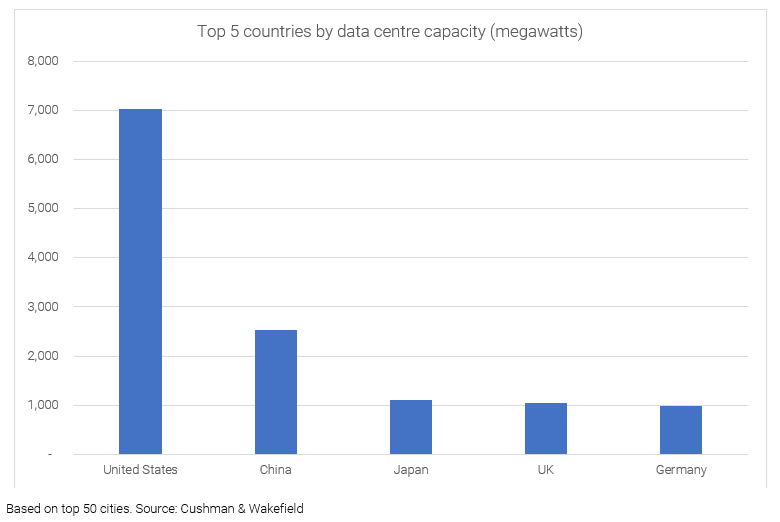

The US is the dominant data centre market

What it means

There are over 5,000 data centres located in the US with a combined capacity of over 7,000 MW – this is more than the combined capacity of the next four largest countries. Over one-third of this capacity is located in North Virginia, the largest market in the world.

The size of the US data centre market should come as little surprise, given the presence of major hyperscale tenants like Microsoft, Amazon, Google and Meta, all of which are headquartered in the US and are primary drivers of data centre demand worldwide.

In short, the biggest opportunities to develop and own are probably in North America.

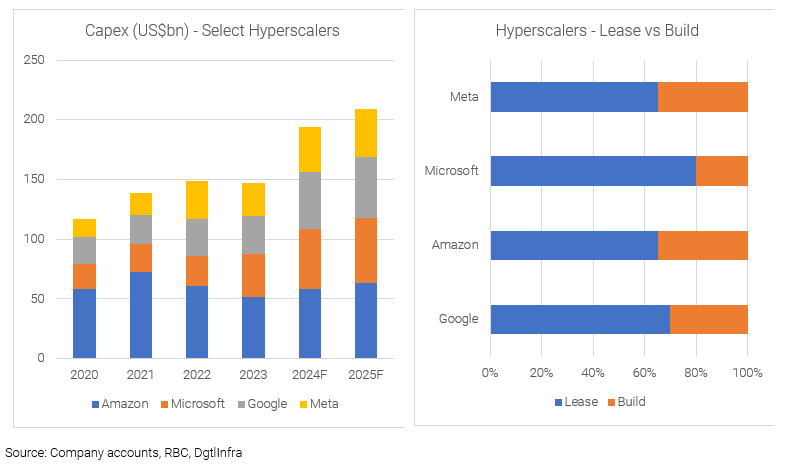

The largest data centre tenants are increasing their spending

What it means

Leasing demand for data centres is derived from two broad sources – hyperscale (very large tech companies like Amazon, Google, Microsoft etc) and retail (banks, companies, government etc).

While demand from retail is ongoing, the demand from AI will initially be led by the hyperscale tenants.

The combined annual capital expenditure of Amazon, Microsoft, Google, and Meta has increased by 26% from 2020 to 2023, with forecasts projecting a further 33% increase by 2025. This anticipated growth is largely driven by investments in cloud infrastructure and the development of generative AI.

Increased capex spending will lead to a need for additional data centre capacity. While these hyperscale tenants do construct their own data centres, on average over 50% of their data centre infrastructure are leased from third party landlords like the data centre REITs.

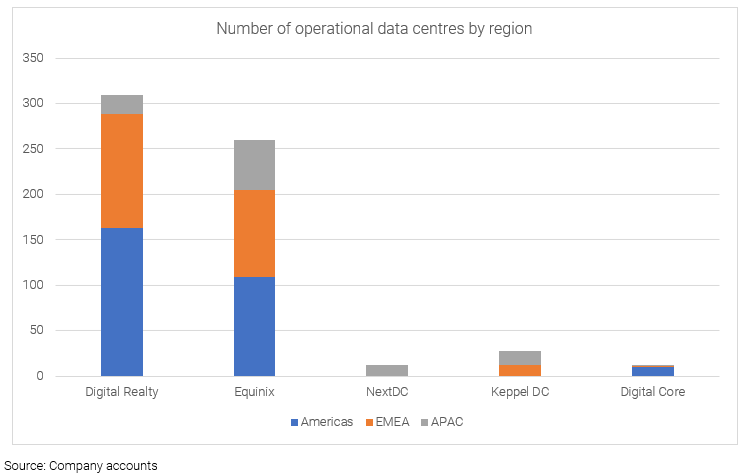

It pays to be big

What it means

While the US remains the hub of data centre activity, data centre owners have been actively broadening their geographical footprint. Over the past decade, the sector has witnessed a wave of M&A activity.

Data is global.

The global user bases of both hyperscale and retail tenants necessitates demand for seamlessly interconnected data centres worldwide. Landlords with extensive scale and a widespread presence hold a distinct advantage in leasing negotiations with these tenants over smaller competitors. This advantage is poised to intensify as the development and deployment of AI technologies mature on a global scale.

There are now only two listed pure-play data centre REITs with significant scale and truly global reach – Digital Realty and Equinix.

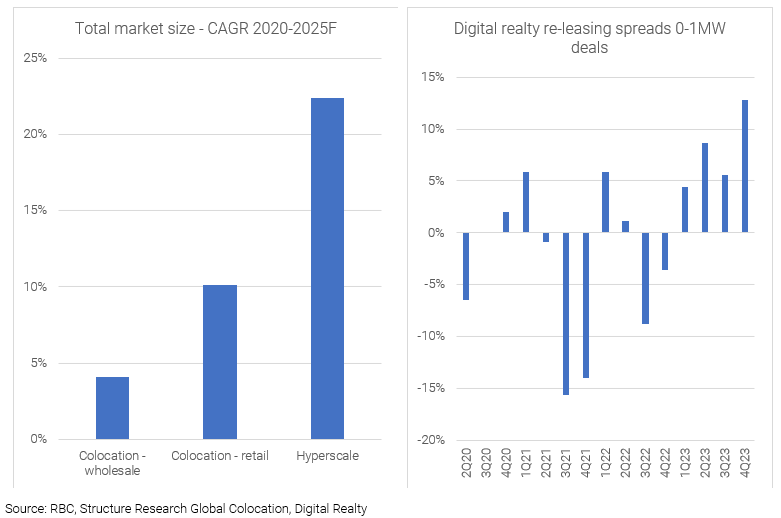

Demand is more than just AI – it is broad based

What it means

Colocation data centres are facilities leased to multiple tenants (businesses, government agencies, and service providers) to house their IT infrastructure. Tenants with larger requirements (e.g. multinational businesses) lease space/power in ‘wholesale’ colocation facilities whereas small to medium businesses typically use ‘retail‘ colocation facilities.

In the current environment, hyperscalers are rapidly absorbing available space and power, and incremental capital is prioritising the development of hyperscale data centres. Additionally, businesses must plan for integrating AI into their future operations by securing additional data centre capacity through leasing agreements today.

Consequently, colocation rents (0-1 megawatts) are growing. This looks set to continue as current power capacity is absorbed and future supply of colocation decreases. The size of the colocation market (i.e. total value of revenue in the market) is forecast to grow at +4% CAGR for wholesale and ~+10% CAGR for retail between 2020 and 2025.

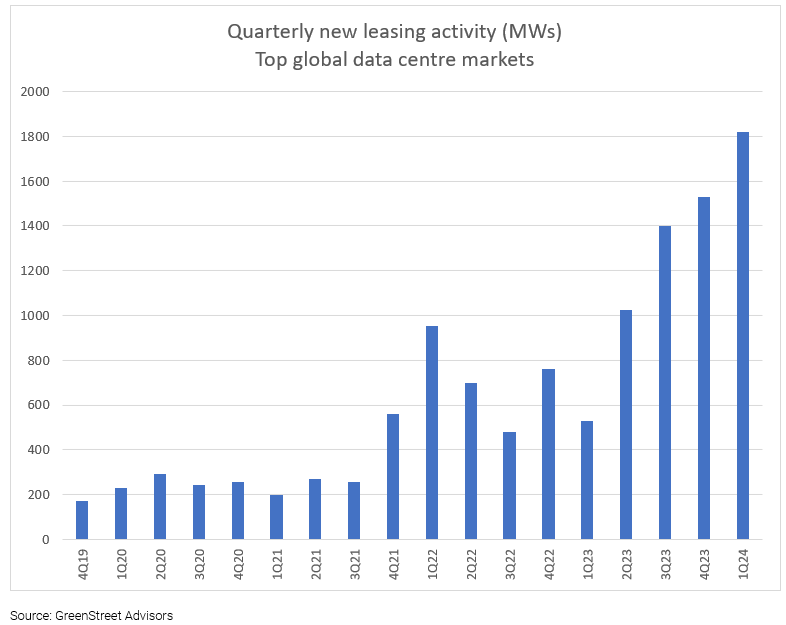

Demand is translating to record breaking leasing

What is means

Demand has arrived.

Global leasing activity has surged, achieving record-breaking levels in each of the last four quarters. Remarkably, more megawatts have been leased in this twelve month period than in the preceding three and a half years.

The question for investors is whether this is demand “brought forward” in anticipation of need or whether the need is here and now.

The answer is probably a little of both. In short, don’t expect leasing volumes to remain at these levels.

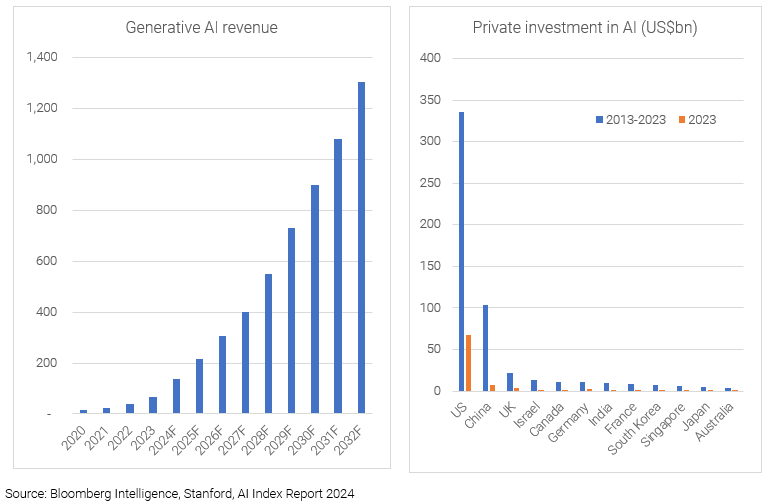

Generative AI is an added tailwind to future demand, particularly in the US

What it means

The size of the generative AI market is set to grow exponentially, with revenues forecast to grow almost 20-fold to US$1.3trillion by 2032. Generative AI requires a tremendous amount of power relative to non-AI use, particularly in the training phase. Growth in the global AI market is certain to create ample demand for additional data centre capacity.

In our view, US based data centres are set to benefit the most. The US is currently the dominant force in AI investment and development. Private investment in AI in the US amounted to $67 billion in 2023, tripling the combined expenditure of the next 10 countries combined. This is largely attributable to a substantial investment in generative AI research.

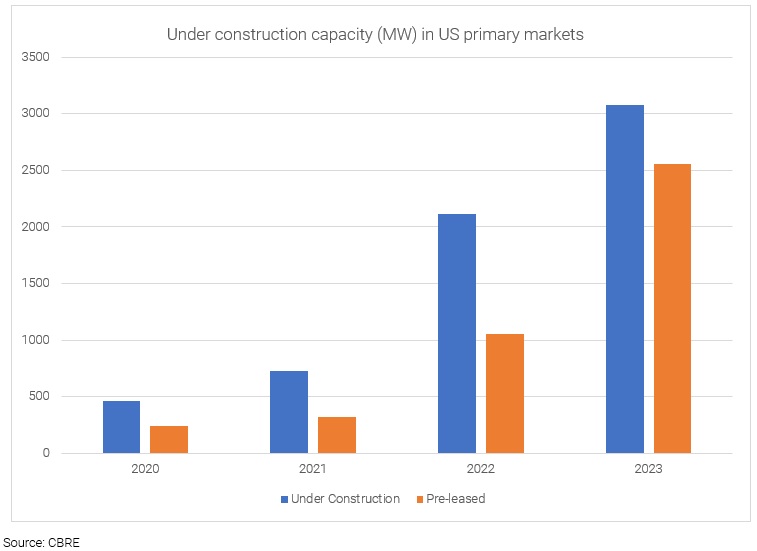

Development profits are lucrative…supply is coming, but mostly pre-committed

What it means

Supply is responding. Capacity under construction in the US has surged to just over 3,000MW at the end of 2023. However over 80% of current construction is already pre-leased, compared to ~50% in prior years. This significantly decreases the risk of oversupply.

With development profits of 40%+ and stabilised net operating income (NOI) yields of 9%+, developments are proving to be lucrative which may suggest supply will accelerate from here (posing future investment risk). However, difficulty sourcing power and procuring generators and transformers are adding multi-year delays to the development timeline.

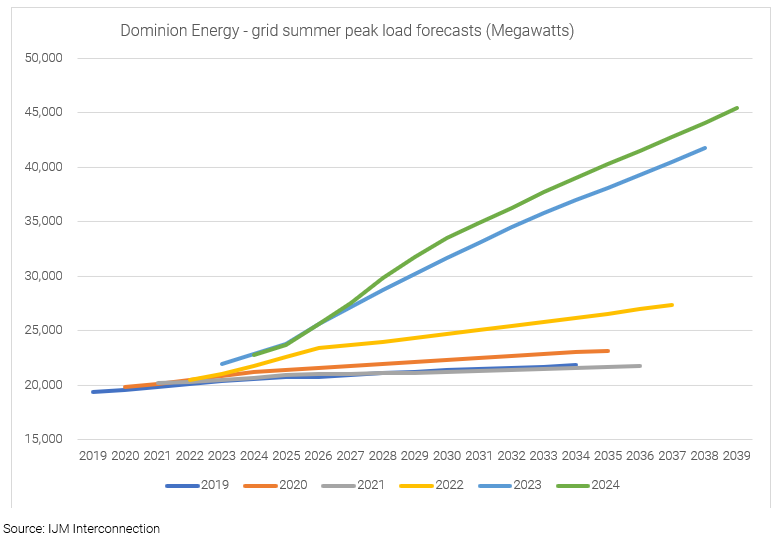

Power constraints will restrict the supply response

What it means

The chart shows the annual 15-year forecast peak power load forecast of Dominion Energy, who is the energy provider for North Virginia and surrounds. Notably, there is a substantial increase in future peak loads forecasted since the 2022 report. Utility providers in the US such as Dominion, have been taken by surprise by the rapid growth of data centre power demands, which has led to years of underinvestment in power generation and transmission infrastructure. There are upwards of seven year wait times for additional power, for development projects in cities such as Los Angeles.

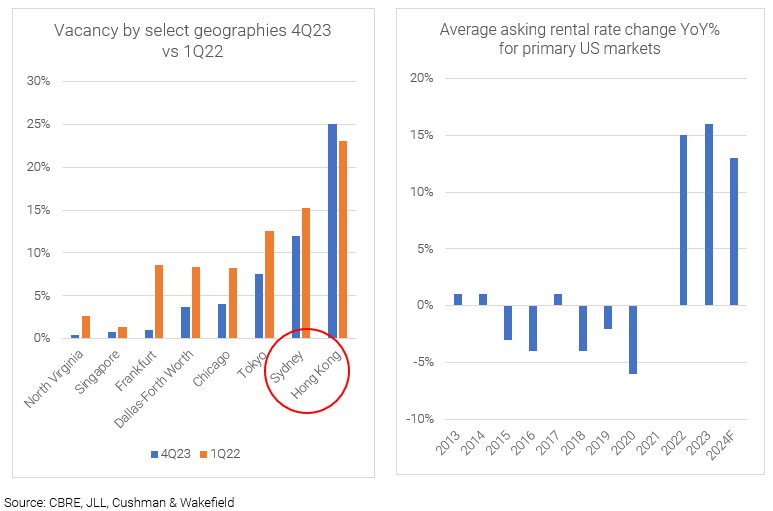

Demand > supply = falling vacancies and surging rents…though not every market is benefiting

What it means

Negotiating power is now firmly in the corner of landlords, particularly in major markets with tight vacancies in the US and Europe. Rental rate growth is now positive after a decade of mostly negative growth. However, due to the long duration (10-15 year) nature of hyperscale leases, strong rental growth does not quickly translate to outsized earnings growth. A significant portion of current rental rolls were signed back when leasing environments were less favourable. Landlords are trying to speed up this process by divesting ‘low growth’ data centres and reinvesting capital into new developments. Nevertheless, it will take time to play out, but the trend is positive.

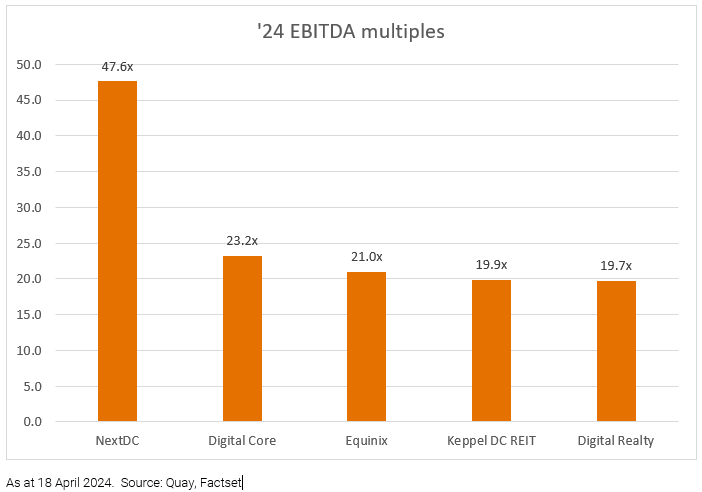

The story is solid but at what price. Where is the value?

What it means

After years of M&A by public REITs and private equity entities, only five listed pure-play data centre REITs remain. Only one of these are listed in Australia and in our view, priced at a premium compared to global peers.

At Quay, we have an ability to invest in better opportunities globally.

In our opinion, data centres are a game of scale and geographic footprint. Also, generative AI leasing-demand will particularly benefit US hyperscale data centres. And of course, valuation matters.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.