Is retail back?

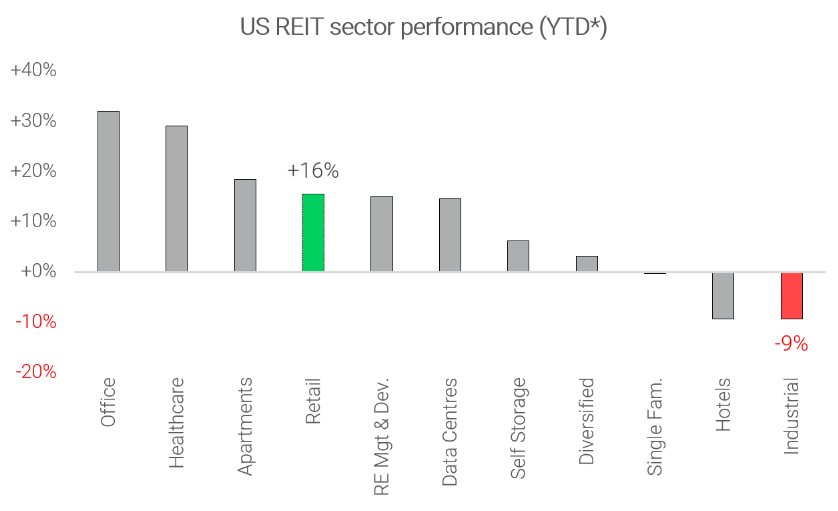

Retail (shopping malls) has been a strong performing sub-sector in global listed real estate’s resurgence. This performance has coincided with the unwinding of the ‘manic 2021 industrial land grab’, where companies aggressively leased warehouse space to improve their online fulfilment capabilities. This momentum is evidenced in the year-to-date price action for US REITs.

Source: Bloomberg, Quay Global Investors. YTD Jan-2024 to Oct-2024*

During the manic 2021 period, the allure of e-commerce led some businesses to neglect the importance of their brick-and-mortar retail footprint. One such business was Nike.

Nike’s new era

In June 2017, Nike launched a strategy called the ‘consumer direct offense’, which outlined a shift toward its direct-to-consumer (DTC) business segment. In pursuit of capturing the volume, retail margin and customer data, the company claimed, “we’re leapfrogging over (the) old models of retail to drive accelerated growth”[1].

Over the following years, Nike invested in its DTC ecosystem with a suite of new mobile apps, roll-out of ‘members only’ Nike live concept stores, and termination of its direct sales relationship with Amazon.

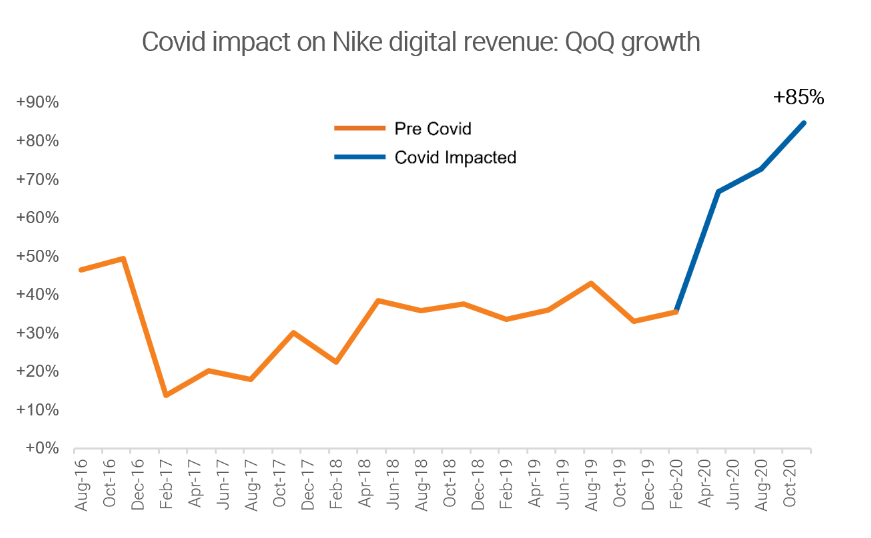

With the arrival of Covid-19, this strategy appeared to be a masterstroke.

2020 saw a once in a lifetime dousing of gasoline onto the fire of e-commerce via substantial government stimulus cheques. Locked inside their homes and with exercise being one of few outlets to stay sane, it’s hardly surprising that people purchased Nike products directly.

Nike Digital exploded.

Source: Company Disclosure, Quay Global Investors

With a formidable combination of sales growth and margin expansion, it was all coming up Nike. Like many across the e-commerce industry, Nike mistook cyclical gains (off a low base) for structural, and doubled down on the DTC strategy.

This included the appointment of a consulting / tech specialist CEO in John Donahoe in January 2020, and a restructuring of the executive management team’s annual cash incentive award to include a ‘digital revenue’ metric in June 2020. ‘Show me the incentive, and I will show you the outcome’ – full steam ahead to 50% digital penetration!

Cutting ties

As part of the push to DTC, Nike made the decision to part ways with many of its long-standing wholesale partners. On an earnings call in March 2022, CFO Matthew Friend said, “over the past four years, we have reduced the number of wholesale accounts worldwide by more than 50%”.

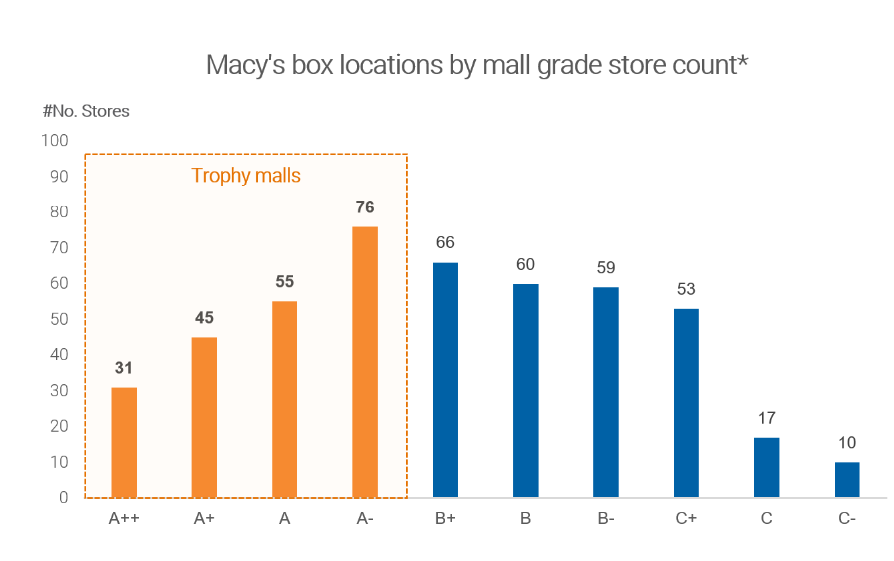

Critical to the wholesale business model is occupying prime floor space in A-grade malls. Nike’s decision to abandon wholesalers was, in essence, a decision to abandon best-in-class brick-and-mortar retail destinations. Macy’s was just one of the accounts that was targeted, and whose exposure to shopping malls, particularly at the higher end of town, is significant.

Source: Company Disclosure, Green Street Advisors, Quay Global Investors.*

Mall-based locations only, excludes Bloomingdale’s and Bluemercury concepts.

Some of the wholesalers that were not entirely cut off, such as Footlocker (+2,500 stores globally), received reduced Nike allocations, particularly in its ‘high heat’ styles (i.e. its best products)[2] For brand agnostic customers that were looking for a new pair of shoes, they were unknowingly comparing Nike’s ‘reserve graders’ to its competitors’ ‘star players’. Without wholesaler and store relationships, the brand was at risk of becoming a commodity.

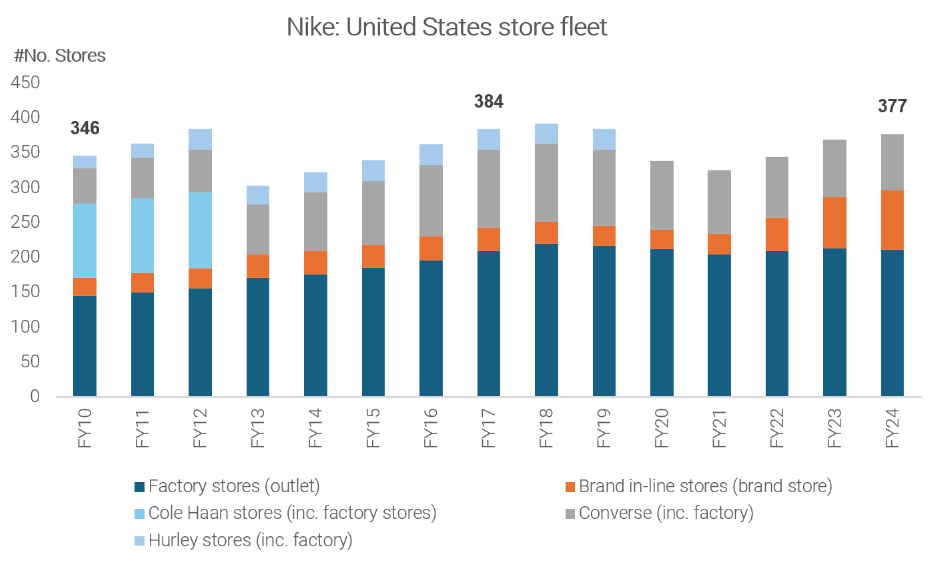

In the US, the wholesale exodus was not offset by a material increase in Nike stores.

Source: Company Disclosure, Quay Global Investors

What can’t be found, can’t be bought

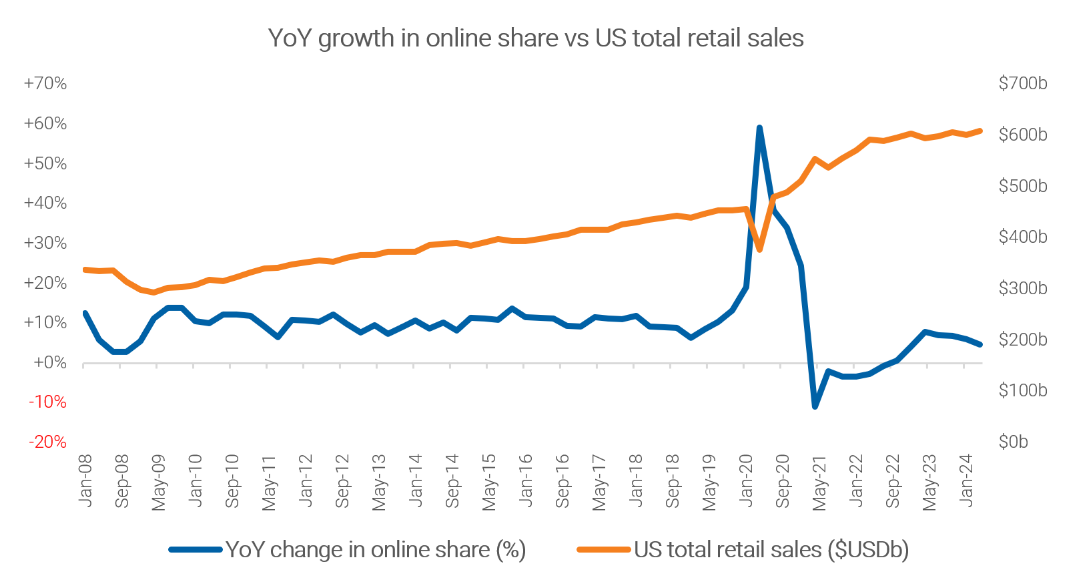

Predictably, as ‘government mandated shop closures’ were removed post-COVID, consumers flocked back to the malls, and physical stores captured wallet share.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors

As consumers returned, Nike products were much harder to find. While some loyalists were pushed to search online, the majority were driven one shelf over to competitor offerings. Nike rapidly began to lose share.

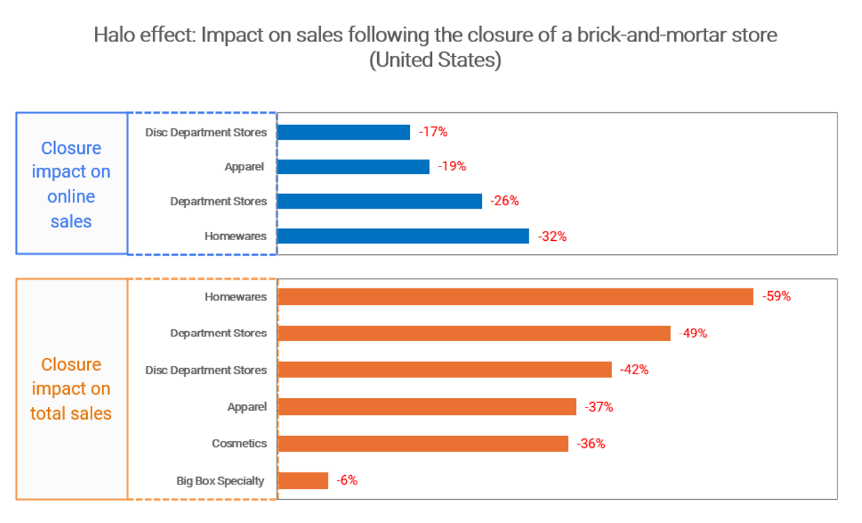

It was becoming clear to Nike (and others) that most physical storefronts do not compete with online channels, rather they drive traffic toward them. The omnichannel approach enables customers to touch, feel and compare a product in-store – then purchase it online at their convenience.

The influence of physical stores on retailer web traffic is referred to as the halo effect. The halo effect can nullify the margin improvements that are flaunted by DTC / e-commerce proponents.

Source: ICSC: The Halo Effect III, Quay Global Investors

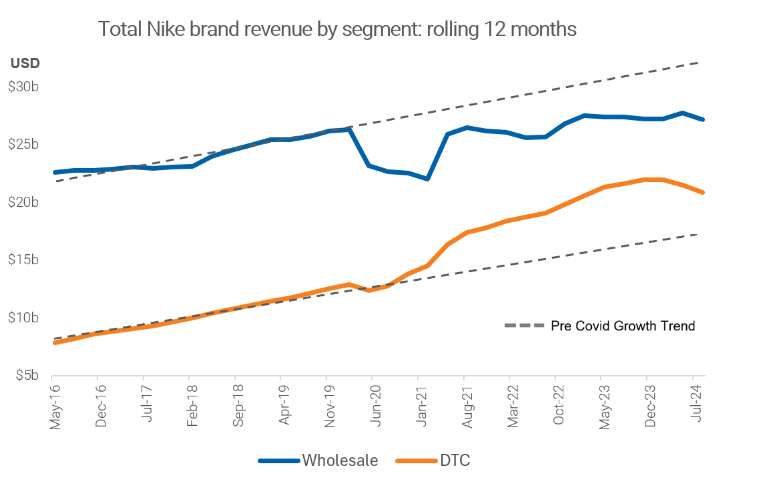

Over the past 18 months, Nike’s DTC revenue growth has flatlined due to a combination of the halo effect, the base effect, and the macroeconomic backdrop of normalised online retail spend. As expected, cutting its partners (abandoning the physical stores) crippled the growth in Nike’s wholesale segment.

Source: Company Disclosure, Quay Global Investors

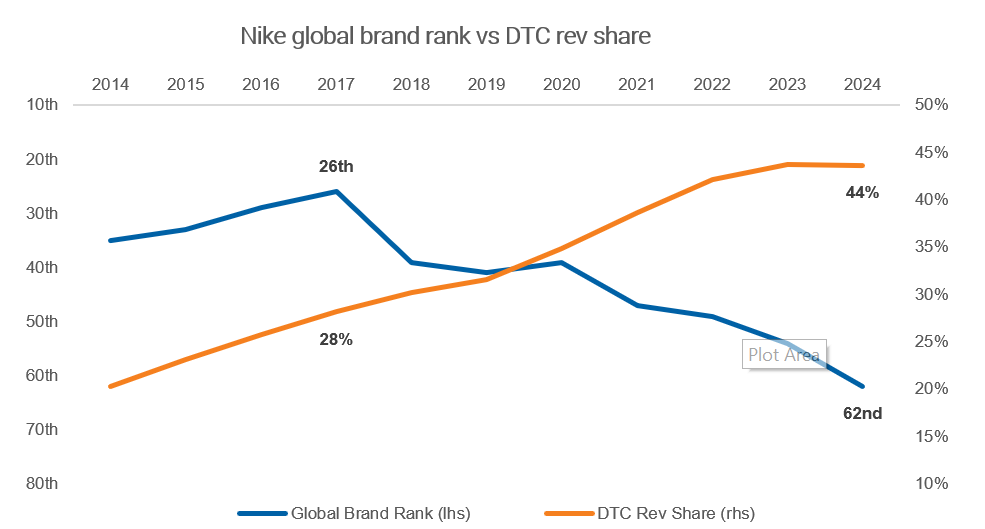

Nike’s earnings profile was tarnished, and the share price has since collapsed ~50% from the November 2021 peak. Worse is the loss of brand value. The June 2017 decision to withdraw from its store and wholesaler relationships perfectly aligned with the slide of Nike’s brand rank from 26th in the world to 62nd.

Source: Company Disclosure, Brand Finance Global 500, Quay Global Investors

To attribute all of Nike’s recent underperformance to its shift in focus towards DTC would be misleading. It had various other commercial issues, including significant supply chain disruptions, oversaturating the market with previously exclusive products, and a failure to successfully innovate.

However, nothing quite says, ‘we got it wrong’ like the Board of Directors directly reversing the major decisions from a few years prior. In recent times, Nike has:

- cut ties with its tech pedigree, CEO John Donahoe;

- re-established partnerships with many of its ex-wholesale partners (and therefore stores); and

- removed the ‘digital revenue’ metric from the annual cash incentive for the executive management team.

When it comes to online retailing, if Nike can’t ‘just do it’, the challenge for smaller businesses with a fraction of the brand equity, market share and financial resources will be all the greater.

Store space is limited

As wholesalers and retailers re-evaluate their store strategy, they may find rebuilding their pre-Covid store footprint to be a challenge. The availability of retail space is getting tight.

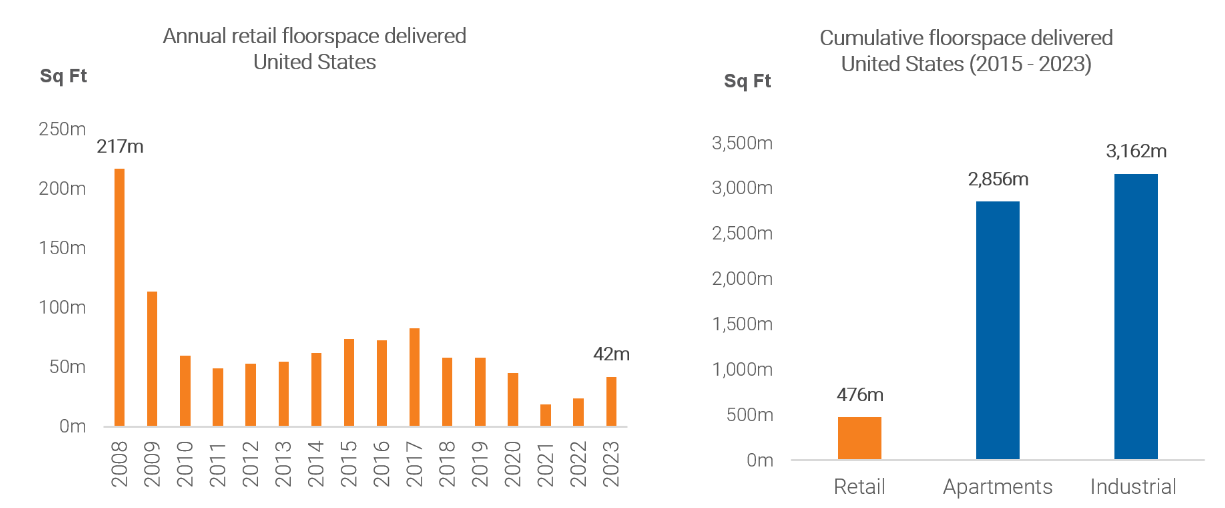

Over the past decade, the delivery of new shopping centre supply has been below historic trend and is dwarfed when compared to alternative asset classes.

Source: CoStar, JLL, Cushman and Wakefield, Quay Global Investors

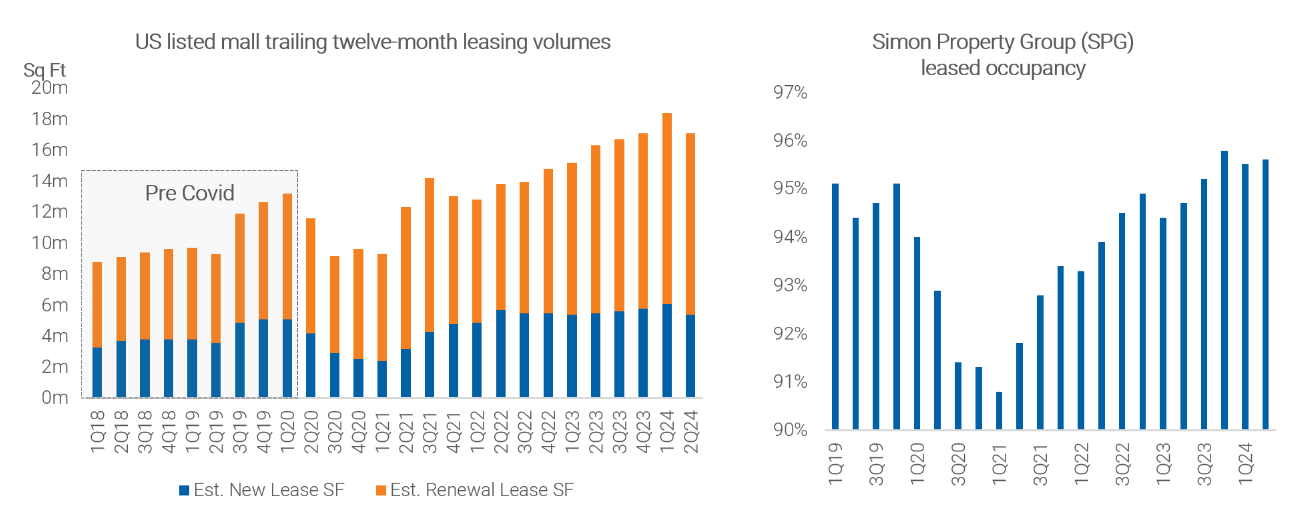

In the current environment, if you are a business re-negotiating your lease term (at an A+ mall), you might want to sharpen your pencil because the landlord on the other side of the table has an increasingly long list of people that want the space. This isn’t anecdotal; it’s in the data.

Source: Company Disclosure, Green Street Advisors, Quay Global Investors

It’s this competitive tension during the leasing negotiations, fueled by retailers’ ‘fear of missing out’, that drives a shopping centre landlords’ top line income growth, not the month-to-month blips in national retail spend or online share of total retail sales. We wrote in more detail about recession resilience in our article, Why best-in-class mall rents are recession resilient.

Concluding thoughts

Hindsight is 20/20, however a case study like Nike reveals valuable lessons for consumer businesses and its brick-and-mortar footprint.

Nike’s experience is not unique. Many other retailers / logistics providers and their enthusiastic investors extrapolated the Covid trends. Meanwhile, the same groups overlooked the importance of physical stores and wholesale partnerships. Unwinding these mistakes will take time and will be expensive.

To be sure, e-commerce spend as a proportion of total retail sales is re-accelerating in the United States, however the lion’s share of this spend is concentrated towards:

- Online stores that accommodate consumers’ preference to compare brands (Amazon); or

- Deep value marketplaces (Temu/Shein)

The Nike experience is consistent with Quay’s long-held views on retail:

- Online retail is here to stay but will be largely the domain of Amazon or low margin commodity merchandise.

- Without a store, brands risk losing value (and with it margin).

- Wholesalers and retailers will require less stores compared to pre-Covid.

- However, the strategically located stores that are retained will be mission critical to the retailer’s brand positioning, profit margins and customer awareness.

- Finding and leasing these stores will become increasingly difficult as the delivery of new supply at the top end of the market remains negligible.

Apple (and the Apple store) got it right 20 years ago. It’s a shame few noticed.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] Trevor Edwards, President-Brand Nike, June 2017 earnings call.

[2] Richard Johnson, Footlocker Chairman, President and CEO - JPM Retail Round Up Conference, April 2022.